Metal Sector Update - Strong pricing trends to boost earnings By Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

A blockbuster quarter

Strong pricing trends to boost earnings

With global economies rebounding from the COVID-19 pandemic, demand for metals improved significantly. This, coupled with a raw material shortage, has pushed metal prices higher. In 3QFY21, average aluminum/zinc prices rose ~13% QoQ each, whereas Indian steel prices rose ~19% QoQ. We expect domestic steel consumption to rise ~7% YoY in 3QFY21.

Steel volume for our coverage universe is seen declining 5%/1% QoQ/YoY due to inventory liquidations in the base quarters. Improved domestic demand and higher regional steel prices led domestic mills to raise HRC and rebar prices. Domestic steel producers raised HRC/rebar prices by INR13,000/t (cumulative) during the quarter. On an average, HRC/rebar prices (exMumbai) were 19% higher QoQ at ~INR46,500/44,000 per tonne. With improved domestic prices and product mix, we expect blended realizations for steel companies to improve by ~INR5,000-6,000/t QoQ in 3QFY21.

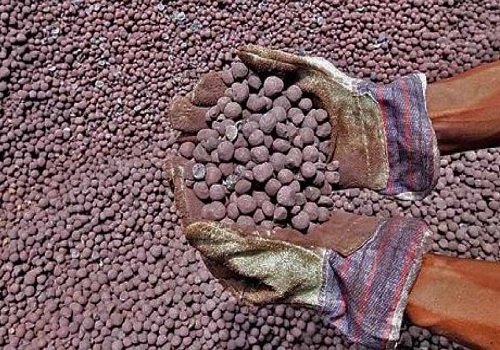

Revenue for steel companies under our coverage (TATA, JSTL, SAIL and JSP) is expected to improve 8% QoQ (12% YoY) to INR885b due to higher realizations. On the cost front, while coking coal prices remain subdued, iron ore prices increased sharply. NMDC raised prices for iron ore fines by INR1,700/t (cumulative) to INR4,600/t. The same averaged ~INR1,100/t higher QoQ.

Coking coal prices averaged 5% lower QoQ at USD119/t. We expect margins for SAIL and TATA to increase by a higher amount given their integrated operations. We expect EBITDA/t for TATA/SAIL/JSP/JSTL to increase by INR4,976/INR5,536/INR3,805/INR2,987. We expect EBITDA for steel companies to increase 41% QoQ to INR212b. For NMDC, we expect EBITDA to rise 180% QoQ to INR29b on the back of higher realization (INR4,949/t, +47% QoQ) and higher volumes (9.4mt, +43% QoQ).

Recovery in LME prices to improve profitability in the Non-Ferrous segment

Strong recovery in LME base metals seen in 2QFY21 continued in 3Q. On an average, aluminum prices were higher by 13% QoQ to USD1,920/t, zinc by 13% QoQ to USD2,633/t, lead by 1% QoQ to USD1,903/t, and copper by 9% QoQ to USD7,108/t. Silver prices increased by 1% QoQ to INR62,400/kg. INR appreciated ~1% against the USD, which should marginally offset the rise in LME prices.

We expect EBITDA for HNDL’s India operations to increase 19% QoQ to INR15.2b on the back of higher LME prices. We expect adjusted EBITDA from Novelis’ operations (including Aleris) to remain strong at USD442m (down 3% QoQ) due to seasonally lower volumes (902kt, down 2% QOQ).

We expect EBITDA for HZ to increase by 4% QoQ to INR30.7b (34% YoY) due to improved LME prices, higher metal volumes, and silver prices. However, the same should get be partially offset by an expected decline in silver volumes. VEDL’s EBITDA (ex-HZ) is expected to improve by 19% QoQ to INR42.7b on the back of an improvement in EBITDA from aluminum, steel, and oil and gas segments.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer