Mentha oil trading range for the day is 1023.3-1105.1 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Gold

Gold yesterday settled up by 0.6% at 52078 as its safe-haven appeal was lifted by concerns over soaring inflation and uncertainty surrounding the war in Ukraine. The Federal Reserve raised borrowing costs by 25 basis points, and since then top Fed policymakers have batted for a more aggressive approach to monetary policy tightening this year to fight rising inflation. Holdings of SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, rose to its highest since February 2021 on Wednesday. The United States and its allies on Thursday imposed fresh sanctions on Russia, targeting dozens of Russian defense companies, hundreds of members of its parliament and the chief executive of the country's largest bank as Washington ramps up pressure on Moscow over its invasion of Ukraine. The U.S. Treasury Department also issued guidance on its website warning that gold-related transactions involving Russia may be sanctionable by U.S. authorities, a move aimed at stopping Russia from evading existing sanctions. India imported 651.24 tonnes of gold in financial year 2020-21 as compared to 719.94 tonnes in the year-ago period, the government said. In a written reply to the Lok Sabha, Minister of State for Commerce and Industry Anupriya Patel said the imports stood at 982.71 tonnes in FY 2018-19. Technically market is under short covering as market has witnessed drop in open interest by -3.14% to settled at 6605 while prices up 311 rupees, now Gold is getting support at 51765 and below same could see a test of 51453 levels, and resistance is now likely to be seen at 52272, a move above could see prices testing 52467.

Trading Ideas:

Gold trading range for the day is 51453-52467.

Gold prices rose as its safe-haven appeal was lifted by concerns over soaring inflation and uncertainty surrounding the war in Ukraine.

SPDR gold holdings highest in over a year

Fed remains behind the curve in fighting inflation

Silver

Silver yesterday settled up by 1.55% at 69320 ahead of US President Joe Biden’s meeting with NATO allies where he is expected to announce additional sanctions against Russia over its invasion of Ukraine. Data showed just how tight the U.S. job market is, with the Labor Department reporting that new filings for unemployment benefits had fallen last week to the lowest level since September 1969. In the prior week, the total number of people continuing to collect jobless benefits after their initial claim was the lowest since January 1970, when the labor force was half the size it is today. The Federal Reserve needs to raise interest rates this year and next to bring down high inflation before it gets embedded in American psychology and becomes even harder to get rid of, Chicago Fed President Charles Evans said. "Monetary policy must shift to removing accommodation in a timely fashion," Evans said in remarks prepared for delivery to the Detroit Regional Chamber, noting that the U.S. central bank's interest rate hike last week was the "first of what appears to be many" this year. Minneapolis Federal Reserve Bank President Neel Kashkari said he has penciled in seven quarter-point interest rate hikes this year to help rein in high inflation, but warned against going too far. Technically market is under fresh buying as market has witnessed gain in open interest by 16.67% to settled at 7068 while prices up 1056 rupees, now Silver is getting support at 68366 and below same could see a test of 67411 levels, and resistance is now likely to be seen at 70012, a move above could see prices testing 70703.

Trading Ideas:

Silver trading range for the day is 67411-70703.

Silver rose ahead of US President Joe Biden’s meeting with NATO allies where he is expected to announce additional sanctions against Russia

Fed's Evans says 'timely' interest rate hikes needed

Fed's Kashkari wants rate hikes, but warns of overdoing it

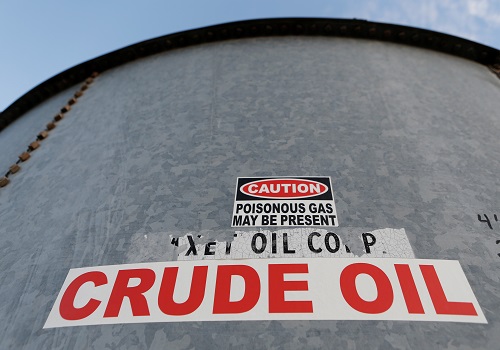

Crude oil

Crude oil yesterday settled down by -0.74% at 8666 after Iran hinted that it may be close to getting a new nuclear deal with the U.S. via negotiations in Europe. Investors also assessed the potential for new supply as the war in Ukraine enters its second month. Traders weighed additional supply disruptions following reports of storm damage at a major export terminal system on the Black Sea. Crude exports from Kazakhstan's Caspian Pipeline Consortium (CPC) terminal had completely halted following storm damage. Russia's Deputy Prime Minister said oil supplies could be stopped for two months. Stockpiles in the U.S. fell by 2.5 million barrels last week, while inventories from the U.S. Strategic Petroleum Reserve declined by 4.2 million barrels, according to data from the U.S. Energy Information Administration. U.S. oil production remained flat at 11.6 million barrels per day, according to EIA data. The International Energy Agency (IEA) urged consumers to travel less, share transport and drive more slowly, part of a 10-point plan to cut oil use as Russia's invasion of Ukraine deepens concerns about supply. The plan by the Paris-based grouping of 31 industrialized countries – which does not include Russia – underlines the urgency of a supply crunch brought on by sanctions and buyer aversion to Russian oil, which has raised fuel prices. Technically market is under long liquidation as market has witnessed drop in open interest by -9.29% to settled at 8049 while prices down -65 rupees, now Crude oil is getting support at 8516 and below same could see a test of 8366 levels, and resistance is now likely to be seen at 8837, a move above could see prices testing 9008.

Trading Ideas:

Crude oil trading range for the day is 8366-9008.

Crude oil dropped after Iran hinted that it may be close to getting a new nuclear deal with the U.S. via negotiations in Europe.

Traders weighed additional supply disruptions following reports of storm damage at a major export terminal system on the Black Sea.

Stockpiles in the U.S. fell by 2.5 million barrels last week

Nat.Gas

Nat.Gas yesterday settled up by 4.38% at 414.6 on forecasts for a return to cooler weather and higher heating demand next week. That U.S. price increase also came as rising global demand for gas to replace Russian fuel after the country's invasion of Ukraine keeps U.S. liquefied natural gas (LNG) exports near record highs and European gas prices about eight times over U.S. futures. The U.S. Energy Information Administration (EIA) said U.S. utilities pulled 51 billion cubic feet (bcf) of gas from storage during the week ended March 18. That was lower than the 56-bcf decline analysts forecast in a Reuters poll and compares with a decline of 29 bcf in the same week last year and a five-year (2017-2021) average decline of 62 bcf. Data provider Refinitiv said average gas output in the U.S. lower 48 states was on track to rise to 93.3 bcfd in March from 92.5 bcfd in February as more oil and gas wells return to service after freezing earlier in the year. That compares with a monthly record of 96.2 bcfd in December. With cooler weather coming, Refinitiv projected average U.S. gas demand, including exports, would rise from 97.0 bcfd this week to 102.3 bcfd next week. The forecast for this week was higher and the forecast for next week was lower than Refinitiv's outlook on Wednesday. Technically market is under short covering as market has witnessed drop in open interest by -32.19% to settled at 3054 while prices up 17.4 rupees, now Natural gas is getting support at 395.2 and below same could see a test of 375.9 levels, and resistance is now likely to be seen at 425.3, a move above could see prices testing 436.1.

Trading Ideas:

Natural gas trading range for the day is 375.9-436.1.

Natural gas climbed on forecasts for a return to cooler weather and higher heating demand next week.

That U.S. price decline came even though rising global demand for gas to replace Russian fuel

EIA said U.S. utilities pulled 51 billion cubic feet (bcf) of gas from storage during the week ended March 18.

Copper

Copper yesterday settled down by -1.12% at 822.45 as downstream demand has been suppressed by spreading pandemic in China, and the transaction could hardly improve in the near future. Most traders rushed to liquidate their stocks approaching the end of the month for exchange of cash as the delivery of monthly long-term orders is about to end. Premiums have been falling in the past two days. The Serbian arm of China's Zijin Mining plans to stop production at its copper smelter for three months to carry out a planned work, the Tanjug news agency reported. Serbia's only copper smelting complex in the eastern town of Bor will be halted from April 20 until the end of July for improvements to bring it in line with environmental protection standards and increase capacity, the report said. The company's 2022 annual plan listed the scheduled maintenance and also set total production at 85,000 tons of cathode copper, 1,580 kilograms of gold and around 13 tons of silver. Kazakhstan's January-February refined copper output fell 3.1% year on year, data from the statistics bureau showed. The global world refined copper market showed a 92,000 tonnes deficit in December, compared with a 123,000 tonnes deficit in November, the International Copper Study Group (ICSG) said in its latest monthly bulletin. Technically market is under fresh selling as market has witnessed gain in open interest by 40.86% to settled at 3130 while prices down -9.35 rupees, now Copper is getting support at 816.8 and below same could see a test of 811.1 levels, and resistance is now likely to be seen at 831.6, a move above could see prices testing 840.7.

Trading Ideas:

Copper trading range for the day is 811.1-840.7.

Copper dropped as downstream demand has been suppressed by spreading pandemic in China

China's Zijin to stop copper smelter in Serbia for overhaul

Kazakhstan's January-February refined copper output fell 3.1% year on year.

Zinc

Zinc yesterday settled down by -3.4% at 333.85 on profit booking as SHFE zinc inventory continued to rise and increased by 1.58% to 176,507 mt, setting a new high in nearly five years. However, downside seen limited amid worries about further suspensions of smelters in Europe due to high power prices. San Francisco Fed President Mary Daly, noted for being more cautious about policy tightening, said that she supports a bigger rate hike if needed to combat inflation given a strong labor market. The terminal consumption has been suppressed by high zinc futures prices, and downstream orders are still waiting for the pivot. The market turned increasingly sluggish amid inflating energy and futures prices. In the spot market, logistics has not improved due to the pandemic. Kazakhstan's January-February production of refined zinc was down 2.9%, data from the statistics bureau showed. The global zinc market deficit declined to 28,400 tonnes in January from a revised shortfall of 45,500 tonnes a month earlier, data from the International Lead and Zinc Study Group (ILZSG) showed. Previously, the ILZSG had reported a deficit of 37,300 tonnes in December. Around 13.5 million tonnes of zinc is produced and consumed each year. Technically market is under fresh selling as market has witnessed gain in open interest by 4.5% to settled at 998 while prices down -11.75 rupees, now Zinc is getting support at 328.4 and below same could see a test of 322.8 levels, and resistance is now likely to be seen at 343.8, a move above could see prices testing 353.6.

Trading Ideas:

Zinc trading range for the day is 322.8-353.6.

Zinc dropped on profit booking as SHFE zinc inventory continued to rise, setting a new high in nearly five years.

The terminal consumption has been suppressed by high zinc futures prices, and downstream orders are still waiting for the pivot.

Kazakhstan's January-February production of refined zinc was down 2.9%, data from the statistics bureau showed

Nickel

Nickel yesterday settled up by 14.17% at 2497.8 as disruptions from the Russia-Ukraine conflict and higher energy costs triggered concerns over global supply. Prices of metals extended gains after Russia said it would seek payment in roubles for gas sales from "unfriendly" countries, sending European gas prices soaring and fuelling worries about more smelter closures. Market supply has been relatively tight for lack of imported goods for quite some time. The London Metal Exchange's (LME) benchmark nickel surged 15% to hit its upper trading limit, reversing direction and climbing for the first time since trading resumed last week. LME benchmark nickel slumped for several days in very low volumes and repeatedly hit its lower trading limits after trade was restarted after a break to calm the market. The global nickel market saw a surplus of 6,000 tonnes in January compared with a deficit of 5,300 tonnes in the same period last year, data from the International Nickel Study Group (INSG) showed. Overall there was a deficit in the nickel market of 157,100 tonnes last year compared with a surplus of 103,700 tonnes in 2021, Lisbon-based INSG added. Western sanctions against Russia over its invasion of Ukraine sparked concerns over the metal supply and supercharged existing upward momentum in the market. Technically market is under short covering as market has witnessed drop in open interest by -2.38% to settled at 205 while prices up 310.1 rupees, now Nickel is getting support at 2343.4 and below same could see a test of 2189 levels, and resistance is now likely to be seen at 2584, a move above could see prices testing 2670.2.

Trading Ideas:

Nickel trading range for the day is 2189-2670.2.

Nickel prices climbed as disruptions from the Russia-Ukraine conflict and higher energy costs triggered concerns over global supply.

LME nickel surged 15% to hit its upper trading limit, reversing direction and climbing for the first time since trading resumed last week.

Nickel briquette prices stood above 200,000 yuan/mt, and demand from nickel sulphate plants may contract.

Aluminium

Aluminium yesterday settled down by -3.72% at 288.75 as rising coronavirus cases in China clouded growth outlook for the top metals consumer, although losses were capped by jitters over supply disruption as Russia-Ukraine peace discussions failed to ease conflict. Australian Prime Minister Scott Morrison announced a ban on alumina and aluminum ores exports to Russia. Australia supplies almost 20% of Russia’s alumina, the key ingredient for producing aluminum, and the move aims to inflict more economic pain for the Krelim over its decision to invade Ukraine. China's aluminium imports in the first two months of 2022 fell 26.2% from a year earlier, data from the General Administration of Customs showed. Arrivals of unwrought aluminium and products – which include primary metal and unwrought, alloyed aluminium – totalled 336,007 tonnes in January and February combined, compared with 455,128 tonnes in the corresponding period last year. Customs also gave the January import figure as 193,177 tonnes, down 37.3% on year, and the February figure as 142,829 tonnes, down 2.6%. The December total was 243,729 tonnes. Germany-based TRIMET will over coming weeks cut aluminium production at its Essen facility by 50% because of higher energy prices after Russia invaded Ukraine, the company said. Technically market is under fresh selling as market has witnessed gain in open interest by 24.39% to settled at 2101 while prices down -11.15 rupees, now Aluminium is getting support at 283.1 and below same could see a test of 277.4 levels, and resistance is now likely to be seen at 299.7, a move above could see prices testing 310.6.

Trading Ideas:

Aluminium trading range for the day is 277.4-310.6.

Aluminium dropped as rising coronavirus cases in China clouded growth outlook for the top metals consumer

China Jan – Feb aluminium imports fall 26.2% on year

Germany-based TRIMET will over coming weeks cut aluminium production at its Essen facility by 50%

Mentha oil

Mentha oil yesterday settled down by -2.42% at 1055.6 on profit booking after prices gained as this time the farmers are planting less mentha crop due to lack of water. Farmers have started buying Mentha roots for sowing Mentha in their fields. However, upside seen limited as the war between Ukraine and Russia having a bad impact on prices. There is a demand for Mentha of about 200 crores in Russia and Ukraine. For this reason, the mentha traders are also worried about the fight between these two countries. Mentha worth six thousand crores is exported every year from all over the country. India is the largest producer and exporter of Mentha Oil and its derivatives. Every year about 20 thousand tons of mentha oil and related products are exported from here to America, China, Europe and South America. Fragrance Market in U.A.E. to Grow at 8.3% CAGR Through 2030, says P&S Intelligence. During the COVID-19 pandemic, the U.A.E. fragrance market was negatively affected. The production of non-essential goods was curtailed, while people were also forced inside their homes. The resulting slump in business, media & entertainment, and social activities reduced the demand for fragrances in the country. In Sambhal spot market, Mentha oil dropped by -5.7 Rupees to end at 1171.6 Rupees per 360 kgs.Technically market is under fresh selling as market has witnessed gain in open interest by 27.31% to settled at 951 while prices down -26.2 rupees, now Mentha oil is getting support at 1039.5 and below same could see a test of 1023.3 levels, and resistance is now likely to be seen at 1080.4, a move above could see prices testing 1105.1.

Trading Ideas:

Mentha oil trading range for the day is 1023.3-1105.1.

n Sambhal spot market, Mentha oil dropped by -5.7 Rupees to end at 1171.6 Rupees per 360 kgs.

Mentha oil dropped on profit booking after prices gained as this time the farmers are planting less mentha crop due to lack of water.

Farmers have started buying Mentha roots for sowing Mentha in their fields.

However, upside seen limited as the war between Ukraine and Russia having a bad impact on prices.

Turmeric

Turmeric yesterday settled up by 2.97% at 8814 amid fears that the new season (MY 2022-23) turmeric production remaining lower than the earlier expectations on account of crop damage caused by unseasonal rains during October and November months appeared to have supported, the prices. Turmeric yield is likely get affected in Marathwada (Maharashtra) and southern Turmeric producing states like Telangana and Tamil Nadu due to crop damage caused by unseasonal rainfall witnessed during October and November months there. As per market feedback concerns over crop damage, fall in yield of new season crop and lower availability of quality produce have led to increase in demand for current season crop, particularly from stockists. For the 2021-22 marketing year, carry forward stock of Turmeric is likely to be around 0.48 lakh tonnes, lower than 0.62 lakh tonnes of the previous year. Mandi arrivals of Turmeric, at all-India level, rose by 57% in December compared to November 2021 though it did not have impact on prices amid pickup in demand. All-India mandi arrivals more than doubled over the corresponding period of the previous year. Increase in mandi arrivals can be attributed to farmers offloading their stocks in response to positive price sentiments. In Nizamabad, a major spot market in AP, the price ended at 8670.6 Rupees gained 39.35 Rupees.Technically market is under short covering as market has witnessed drop in open interest by -6.22% to settled at 12070 while prices up 254 rupees, now Turmeric is getting support at 8562 and below same could see a test of 8310 levels, and resistance is now likely to be seen at 8984, a move above could see prices testing 9154.

Trading Ideas:

Turmeric trading range for the day is 8310-9154.

Turmeric gained amid fears that the new season (MY 2022-23) turmeric production remaining lower than the earlier expectations

Turmeric yield is likely get affected in Marathwada, Telangana and Tamil Nadu due to crop damage caused by unseasonal rainfall

For the 2021-22 marketing year, carry forward stock of Turmeric is likely to be around 0.48 lakh tonnes, lower than 0.62 lakh tonnes of the previous year.

In Nizamabad, a major spot market in AP, the price ended at 8670.6 Rupees gained 39.35 Rupees.

Jeera

Jeera yesterday settled up by 0.23% at 21765 as there were reports of decline in sowing area and improving domestic demand. The export of cumin in April-January declined by 23% year-on-year to 1.88 lakh tonnes as compared to 2.44 lakh tonnes in the previous year. Pressure also seen due to tensions between Ukraine and Russia which may disrupt shipments of spices to Europe and other destinations. In 2021-22, the area under cumin in Gujarat is only 3.07 lakh hectares as compared to 4.69 lakh hectares in the same period last year and production is expected to decline by 41% to 2.37 lakh tonnes as compared to last year's 4 lakh tonnes as per second advance estimates. The area under jeera has decreased by about 30% in Rajasthan this year, to 5.39 lakh hectares (lh) from 7.7 lh last year, Spices Board officials confirmed. According to the data released by the commerce department, cumin exports in January 2022 increased by 19% to 14,725 tonnes as compared to 12,385 tonnes in December 2021. Carry-forward stocks would be approximately 25 lakh bags. Last year's jeera crop was 93 lakh bags, with a carryover stock of 20 lakh bags. The decline in the jeera area is more pronounced in Rajasthan, where farmers have shifted to mustard because prices for the oilseed crop were favourable during the sowing season. In Unjha, a key spot market in Gujarat, jeera edged up by 182.35 Rupees to end at 21300 Rupees per 100 kg.Technically market is under short covering as market has witnessed drop in open interest by -1.31% to settled at 10812 while prices up 50 rupees, now Jeera is getting support at 21540 and below same could see a test of 21315 levels, and resistance is now likely to be seen at 21985, a move above could see prices testing 22205.

Trading Ideas:

Jeera trading range for the day is 21315-22205.

Jeera gained as there were reports of decline in sowing area and improving domestic demand.

The export of cumin in April-January declined by 23% year-on-year to 1.88 lakh tonnes

However, there were reports of decline in sowing area and improving domestic demand.

In Unjha, a key spot market in Gujarat, jeera edged up by 182.35 Rupees to end at 21300 Rupees per 100 kg.

Cotton

Cotton yesterday settled down by -0.05% at 40950 on profit booking after prices rose to all time high amid strong demand and possible lower supplies. Atul Ganatra, president of Cotton Association of India said that demand in local mills is good and new spinning mills are coming up. Demand is good but the profit that spinning mills were earnings has been reduced and now they will be at par or there will be a loss to the spinning mills at a high rate of cotton. Due to high rate of cotton, sowing likely to increase 15-20 percent in the season. USDA’s weekly export sales data showed that cotton shipments reached 96% of the USDA’s marketing year estimates to 371,400 bales, which is also 5% more than that of the previous week and 34% higher from the prior 4-week average. At the same time, concerns grew over the drought conditions in West Texas on the back of lower than normal precipitation forecasts for the area. Also, USDA in its March 10th report estimated 2021/22 global cotton consumption to be 111,000 bales higher compared to last month’s projections while it sees world ending stocks 1.7 million bales lower due to smaller global production, particularly from India. Cotton production at 340.63 lakh bales for this season (October 2021-September 2022) against 352.48 lakh bales last season, as per second advance estimate, the Union Ministry for Agriculture and Farmers Welfare. In spot market, Cotton gained by 310 Rupees to end at 40520 Rupees.Technically market is under fresh selling as market has witnessed gain in open interest by 4.8% to settled at 5591 while prices down -20 rupees, now Cotton is getting support at 40560 and below same could see a test of 40170 levels, and resistance is now likely to be seen at 41240, a move above could see prices testing 41530.

Trading Ideas:

Cotton trading range for the day is 40170-41530.

Cotton dropped on profit booking after prices rose to all time high amid strong demand and possible lower supplies.

CAI said that demand in local mills is good and new spinning mills are coming up.

Due to high rate of cotton, sowing likely to increase 15-20 percent in the season.

In spot market, Cotton gained by 310 Rupees to end at 40520 Rupees.

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Residential realty demand may grow 5-10%, but recovery to pre-pandemic levels only after FY23

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...