Mcx gold prices tumbled almost 0.60% on Monday due to stronger US dollar index and rise in 10 year US bond yields - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

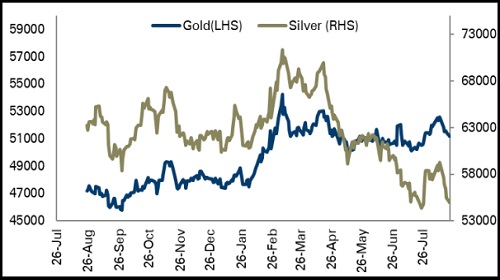

Bullion Outlook

• MCX gold prices tumbled almost 0.60% on Monday due to stronger US dollar index and rise in 10 year US bond yields

• However, risk aversion in global markets restricted further downsides in safe haven assets

• MCX gold prices are expected to trade with a negative bias for the day amid rising US dollar index. MCX gold prices are likely to break the hurdle of | 51,040 to continue its downward trend towards the level of | 50,950

• Additionally, silver prices are expected to take cues from gold prices and may move towards | 54,200 level in coming session

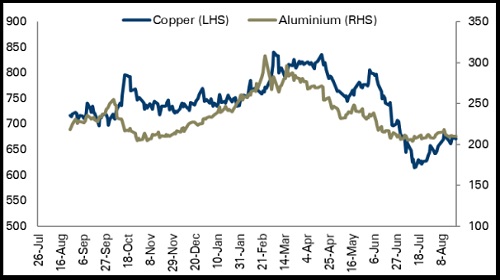

Base Metal Outlook

• MCX copper and aluminium prices slipped on Monday amid manufacturing slowdown in top metals consumer China. In recent months, Covid-19 lockdowns have weakened demand for the metal used widely in the power and construction industries

• However, sharp drop in LME warehouse inventories prevented further downside in copper and aluminium prices

• We expect MCX copper prices to drop for the day amid expectations of weak manufacturing PMI data from the US, eurozone and the UK. It is likely to break the hurdle of | 665 to continue its downward trend towards | 661 leve

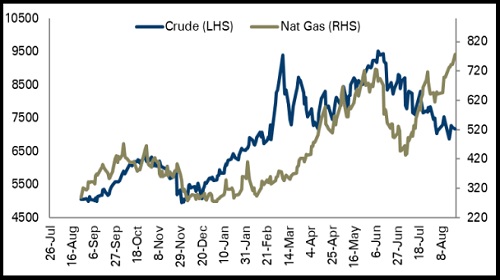

Energy Outlook

• MCX crude oil prices eased almost 0.70% on Monday amid worries that aggressive US interest rate hikes may lead to a global economic slowdown and dent fuel demand

• However, sharp downside was restricted after the Saudi energy minister said Opec+ could cut production to confront market challenges

• We expect MCX crude oil prices to trade with a negative bias for the day amid worries over slowing fuel demand in China, the world's largest oil importer, partly because of a power crunch in the southwest

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer