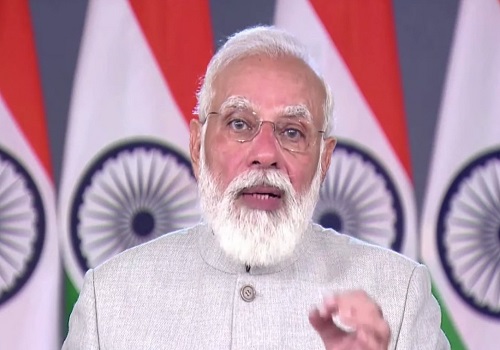

Market Wrap Up - Banking propelled indices higher; but midcaps witness profit booking by Mr. Ruchit Jain, Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is quote on Market Wrap Up - Banking propelled indices higher; but midcaps witness profit booking by Mr. Ruchit Jain, Senior Analyst - Technical and Derivatives, Angel Broking

Post creating new records on Tuesday, Nifty started the day with a gap up around 16200 and maintained a positive bias throughout the day. The upmove was mainly led by the banking heavyweights and Nifty managed to end the day above 16250 with gains of eight-tenths of a percent.

For the second consecutive session, the index showed immense strength and continued to march higher led by the banking heavyweights. The Bank Nifty index showed a catch up move to the recent underperformance and surpassed the 36000 mark. However, inspite of the key indices holding strong, the broader markets witnessed profit booking and hence, the Nifty Midcap index ended with a loss of over a percent. This could be seen as a divergence which indicates that the market moves may not be as smooth as one would like it to be post such breakout. Traders should be very selective in picking stocks and look to trade only such pockets which are showing strength. Positional traders should also look to take some money off the table as profit booking is also one of the most important part of trade management.

As far as Nifty levels are concerned, immediate supports for Nifty are placed around 16175 and 16000 while 16300-16400 are the levels to watch on the higher side. In next couple of sessions, events such as weekly expiry and then the RBI Policy outcome could lead to some volatility. Hence, traders are advised to trade with a proper risk management and keep booking timely profits.

Above views are of the author and not of the website kindly read disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Market Wrap Up : Nifty eventually ended with gains of 0.56% at 17722 Says Mr. Rajesh Bhosale...