Market Roundup : Market seems to be taking a pause before resuming its fresh rally Says Mr. Siddhartha Khemka, Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Daily market commentary 10 August 2022 by Mr. Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd.

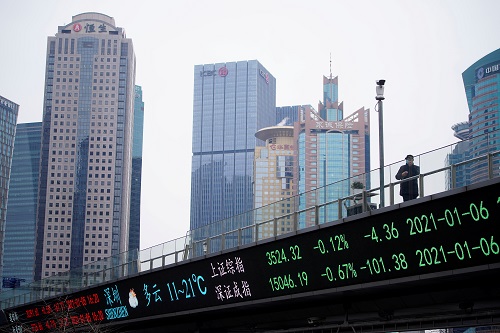

Global as well as domestic markets were lackluster after China’s CPI inflation accelerated 2.7% in July, its highest level in two years and ahead of release of US inflation data. Nifty opened higher and consolidated in a narrow range to finally close with marginal gains at 17,535 levels. Broader market ended in red with Nifty Midcap 100 down -0.2% and Nifty Smallcap 100 down -0.4%. Sector wise it was mixed bag with Metals, Private Banks and Auto top gainers. While IT, Realty, Consumer Durables, PSU Bank, FMCG and Oil & Gas being laggards.

After rising more than 2000 points from June lows, Nifty is currently trading at 20x FY23 PE, which is above its 10-year average, thus offering limited upside in the near term. Market seems to be taking a pause before resuming its fresh rally. Despite mixed global cues, increasing geopolitical tensions and higher volatility, Indian equities are holding out well with strong buying emerging at lower levels. Going ahead, a tug-of-war between global and domestic factors would determine the market direction. Release of U.S. inflation data today (Wednesday) and domestic inflation data on Friday could provide direction to the market. While large caps have already moved up, we expect outperformance from midcaps to continue from hereon.

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Market Wrap Up : Bulls continue their winning streak for the fifth consecutive session says ...