MCX gold prices traded flat on Monday despite a strong US dollar index - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

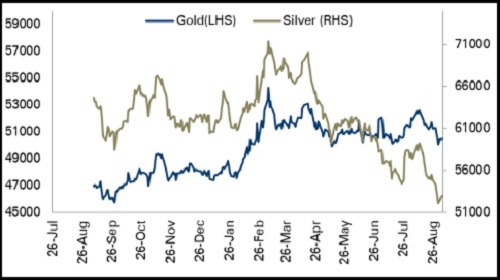

Bullion Outlook

• MCX gold prices traded flat on Monday despite a strong US dollar index

• However, bullion prices were pressurised on hopes of aggressive interest rate hikes by US Fed

• MCX gold prices are expected to trade with a negative bias for the day amid a strong US dollar index. It is likely to break the support level of | 50,370 to touch the level of | 50,200 in the coming session. Additionally, silver prices are expected to take cues from gold prices and trade toward the level of | 53,000

• Investors will closely watch key economic events from the US

MCX Gold vs Silver Performance

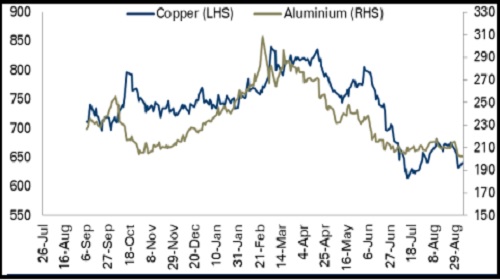

Base Metal Outlook

• MCX copper prices advanced yesterday amid strong economic data from China

• The Caixin China General Services PMI fell to 55.0 in August. Still, the latest print was the third straight month of growth in services activity, as new orders grew solidly with the rate of increase the second-steepest since October 2021 while broadly in line with the series average

• We expect copper prices to trade with a negative bias for the day on concerns over a slowdown in global economic growth, which could dent base metals demand

MCX Copper vs. Aluminium Performance

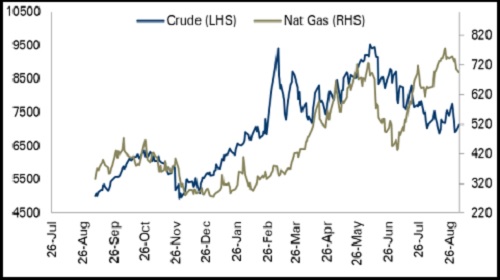

Energy Outlook

• MCX crude oil prices rose about 2.20% on Monday, as Opec+ members agreed to a small production cut of 100,000 barrels per day to bolster prices

• However, further upside was prevented by comments from the White House that US President Joe Biden was committed to taking all steps necessary to shore up energy supplies and lower prices

• We expect MCX crude oil prices to trade with a negative bias for the day on expectations of a rise in energy supplies and reduction in prices

MCX Crude Oil vs. Natural Gas Performance

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer