MCX gold prices edged higher yesterday amid weakness in US dollar index - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

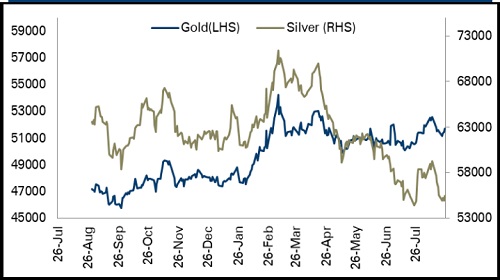

Bullion Outlook

• MCX gold prices edged higher yesterday amid weakness in US dollar index

• Further, bullion prices were supported as the US economy contracted an annualized 0.6% on quarter in Q2 of 2022

• MCX gold prices are expected to trade with a positive bias for the day amid weak US dollar. MCX Gold prices likely to surpass the hurdle of | 51,850 to continue its upward trend towards the level of | 51,960

• Additionally, investors will closely watch key macro economic data from the US

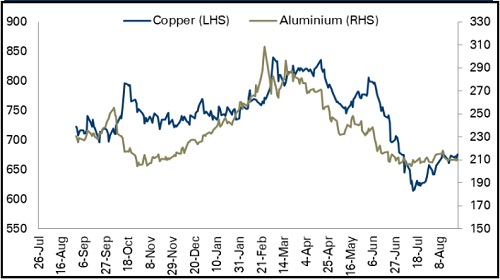

Base Metal Outlook

• MCX industrial metals prices advanced on Thursday after a new injection of stimulus in China that could fuel infrastructure projects and boost industrial metals demand

• China has added 19 new policies on top of existing measures, including raising the quota on policy financing tools by 300 billion yuan ($43.69 billion)

• MCX copper prices are expected to rise for the day as the China has boosted demand growth estimates for copper in China this year to 3.6% from 2.2%. It is likely to trade in the range of | 673 to | 690 in the coming sessions

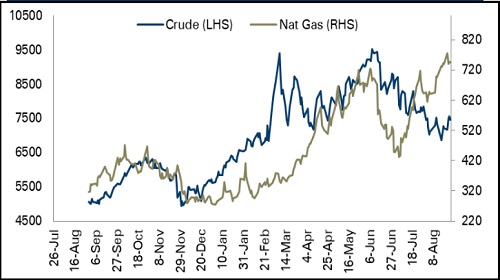

Energy Outlook

• MCX crude oil prices eased by 0.65% as investors braced for the possible return of sanctioned Iranian oil exports to the market

• However, prospect that the OPEC+ producer group could curb oil supplies limited the decline in oil prices

• We expect MCX crude oil prices to trade with a negative bias for the day on worries that rising U.S. interest rates would weaken fuel demand

• Additionally, investors will keep an eye on U.S. Baker Hughes Total Rig Count

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer