MCX gold prices are expected to trade with a negative bias due to stronger dollar index - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

* Comex gold prices eased almost 0.50% on Friday amid a sharp rise in dollar index and on positive sentiments in the US markets

* Further, disappointing macroeconomic data from the US and concerns over geopolitical uncertainty lifted demand for safe haven assets

* However, prospects of aggressive monetary tightening policy by the US Fed continued to pressurise bullion prices on higher side

* MCX gold prices are expected to trade with a negative bias due to stronger dollar index. It is facing resistance at 50 DMA, which is around | 51,200. As long as it sustains below this level, it is likely to correct towards | 50,400 in the coming days

* Silver prices are expected to take cues from gold prices and may move towards | 60,000 levels for the day..

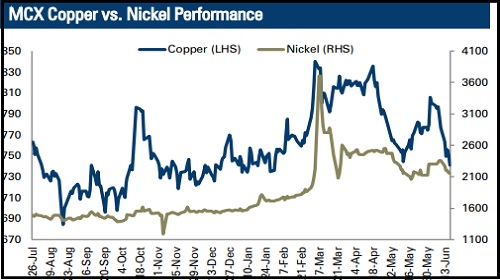

Base Metal Outlook

* MCX copper and other industrial metal prices declined on Friday amid an uptick in US dollar and unsatisfactory macroeconomic data from the US

* Production at US factories unexpectedly fell in May, the latest sign of cooling economic activity as the Federal Reserve aggressively tightens monetary policy to tame inflation

* However, workers at Chilean state-owned miner Codelco, the world's largest copper producer, said on Saturday they will start preparations for a national strike after the firm announced the closure of the troubled Ventanas smelter

* MCX copper prices are likely to slip towards | 730 levels due to concerns over a slowdown in US housing activities, which may lower the industrial metal demand

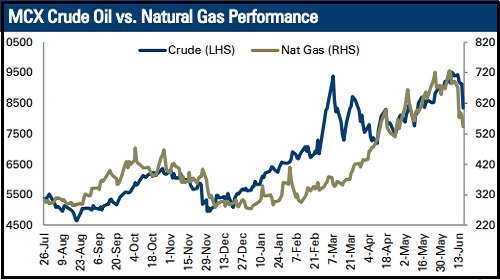

Energy Outlook

* WTI crude oil prices retreated almost 6.0% on worries that interest rate hikes by major central banks could slow the global economy and cut demand for energy

* Moreover, Russia expects its oil exports to increase in 2022 despite western sanctions and a European embargo, the Russian deputy energy minister said on Friday

* Additionally, the first export of crude from Venezuela to Europe in more than two years may put some pressure on prices in coming sessions

* MCX crude oil prices are expected to trade with a negative bias on expectation of oil supply resume from Venezuela. It is trading below support levels of 50 DMA (| 8,465). As long as it sustains below this level, it is likely to slip towards 100 DMA, which is around | 8015 in the coming sessions

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...