MCX gold prices are expected to trade with a negative bias - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Comex gold prices declined around 0.80% on Friday amid optimistic sentiments in global markets and on elevated US 10 year treasury yields

• Further, expectations of aggressive monetary tightening policy by the US Fed to cool down inflation dented demand for precious metals

• However, disappointing macroeconomic data from the US and weakness in US dollar index limited further downsides in bullion prices

• MCX gold prices are expected to trade with a negative bias due to rise in risk appetite in US markets. It is trading below the key support levels of 100 day moving average (| 50,270). As long as it sustains below this level, it is likely to correct towards | 49,400 levels for the day

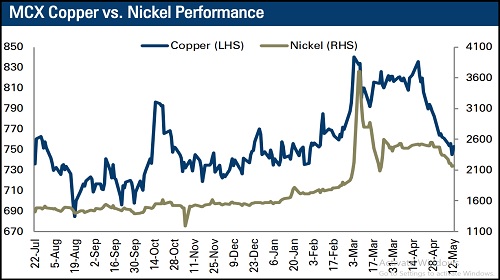

Base Metal Outlook

• LME aluminium prices rebounded more than 3.0% on Friday amid a retreat in US dollar index and as investors hoped for easy monetary policy support from China’s central bank

• Further, aluminium prices gained as smelters in Europe reduced their output of aluminium in recent months amid higher energy cost

• Moreover, China exported 45,260 tonnes of primary aluminium in March, the highest monthly total since April 2010

• MCX aluminium prices are expected to trade with a positive bias for the day due to continuous decline in LME inventories. It has been taking support at | 232 level over the last couple of days. As long as it sustains above this level, it is likely to rally towards | 240 for the day

Energy Outlook

• WTI crude oil prices rallied around 4% on Friday as US gasoline prices jumped to a record high and China ready to ease pandemic restrictions

• Further, oil prices have been supported by worries over a possible EU ban on Russian oil could tighten supplies

• As per IEA report showed, world oil demand is set to rise by 3.6 mb/d from April to August. For 2022, demand is expected to increase by 1.8 mb/d on average to 99.4 mb/d

• Additionally, US total rigs count increased to 714 from 705 over the last week, their highest since April 2020

• MCX crude price are expected to rally further towards | 8,650 for the day due to concerns over tight supply and higher fuel demand from US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

.jpg)