MCX gold price is trading above the key resistance of 100 day moving average - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

• MCX gold prices rebounded around 1.20% on Thursday amid a sharp decline in US 10 year bond yields and risk aversion in the global markets

• Moreover, disappointing economic data from the US boosted demand for precious metal. The number of Americans filing new claims for unemployment benefits increased to 218,000 from 197,000 for the week ended 14 May 2022

• Further, rising inflationary pressures and concerns over slowdown in global economic growth provided support to bullion prices on the lower side

• MCX gold price is trading above the key resistance of 100 day moving average, which is around | 50,370. As long as it sustains above this level, it is likely to rise towards | 50,850 levels for the day. Silver prices are expected to take cues from gold prices and its likely to move towards | 62,000 levels for the day

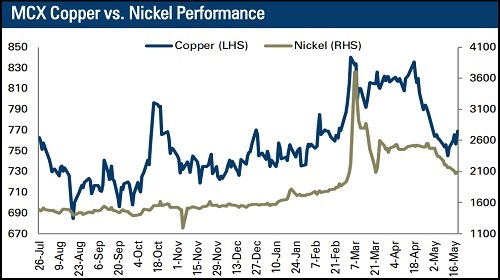

Base Metal Outlook

• LME Copper and aluminium prices rallied on Thursday as easing Covid-19 restrictions in China raised hopes for industrial metal demand revival

• Further, retreat in US dollar index coupled with a sharp decline in LME copper stockpiles continued to support metal prices on the lower side

• However, unsatisfactory existing home sales data from the US capped further gains in base metal prices. US existing home sales eased to 5.61 million units in April 2022 compared to 5.75 million units in the previous month, lowest level in nearly two years primarily due to house prices jumped to a record high

• MCX copper prices are expected to rally towards | 775 levels for the day due to weakness in dollar index and on expectations of easy monetary policy from China’s central bank

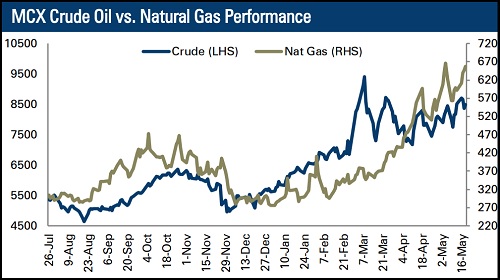

Energy Outlook

• WTI crude oil prices gained almost 2.60% on Thursday as Chinese officials planned to ease lockdown and travel restrictions in China, which could further tighten global energy supply

• At the same time, oil prices have been supported by possibility of a European Union ban on Russian oil imports

• US natural gas prices declined more than 1.50% on Thursday after the EIA reported that utilities added 89 billion cubic feet (bcf) of gas over the last week, which was higher than expected natural gas injection into storage

• MCX natural gas price is facing strong resistance at | 663 levels over the last couple of trading sessions. As long as it sustains below this level, it is likely to correct towards of | 615 in the coming days. Additionally, investors will keep an eye on rig counts data from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Sell Zinc Sep 2021 @ 246.00 SL 248.00 TGT 244.00-242.00.MCX - Kedia Advisory