MCX crude oil prices are likely to head further towards 9000 levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

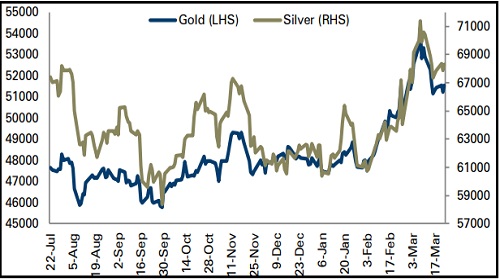

Bullion Outlook

Gold prices rebounded by 0.95% on the back of disappointing macroeconomic data from the US and on retreat in US treasury yields. US 10 year treasury yields declined to 2.32% from its recent high, reducing the opportunity cost of holding non-yielding bullion

Further, market participants waited for US President Joe Biden to announce more sanctions against Russia during his trip to Europe, which lifted demand for safe haven assets

MCX gold prices are likely to rise further towards | 51,900 levels due to concerns over Russia-Ukraine turmoil and on pessimistic sentiments in the global markets. Silver prices are expected to take cues from gold prices and move further towards | 69,000 level for the day. However, hawkish stance by Fed officials to combat the elevated inflation may cap further upsides in bullion prices. Additionally, investors will keep an eye on Initial jobless claims data from the US

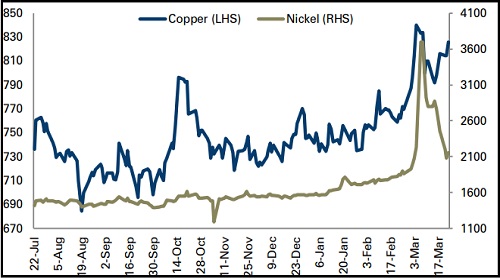

Base Metal Outlook

Copper and other industrial metal prices surged on Wednesday amid consistent decline in LME inventories

Moreover, investors remain worried about further suspension of smelters in Europe due to high energy prices providing significant support to the industrial prices on the lower side

However, sharp upsides were restricted by disappointing new homes sales data from US. US new home sales slipped to 772,000 units in February 2022 compared to 788,000 units in the previous month, as mortgage rates increased to the highest in three years

MCX Metldex prices are expected to trade with a positive bias due to falling LME inventories and on easy monetary policy support from the China. However, rise in dollar index will continue to pressurise industrial metal prices on higher side. Additionally, investors will remain cautious ahead of manufacturing PMI data from the US

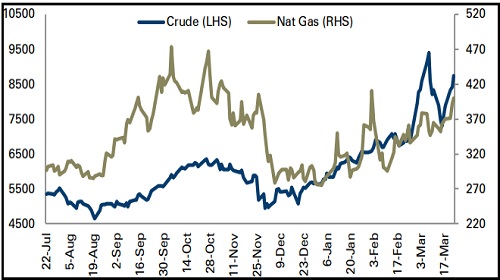

Energy Outlook

Crude oil prices rallied by 5.23% on Wednesday after weather related supply disruptions at Russian CPC pipeline raised concerns over tight global supplies

According to Russian Deputy Prime Minister crude oil exports from Kazakhstan's CPC terminal on Russia's Black Sea coast halted completely for up to two months after damage caused by a major storm, which ships around ~1.2 million barrels per day of crude oil

US crude oil inventories declined by 2.50 million barrels over the last week, which was more than expected draw level of 0.11 million barrels.

MCX crude oil prices are likely to head further towards | 9000 levels due to supply disruptions from Russia and on significant decline in US crude oil stockpiles

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer