MCX copper prices traded flat yesterday despite expectations of better metals demand - ICICI Direct

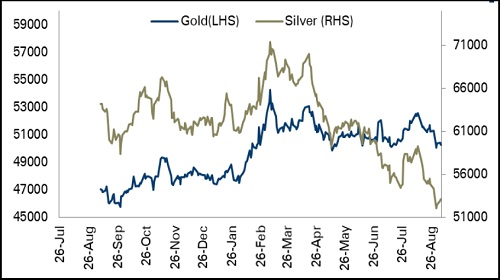

Bullion Outlook

• MCX gold prices edged lower on Tuesday as bond yields surged and the US dollar traded at a 20-year high

• Further, strong economic data from the US pressurised bullion prices

• MCX gold prices are expected to trade with a negative bias for the day amid strong US dollar. It is likely to break the support of | 50,200 to touch the level of | 50,000 in the coming session

• Additionally, investors will stay vigilant ahead of key economic data from the US

MCX Gold vs Silver Performance

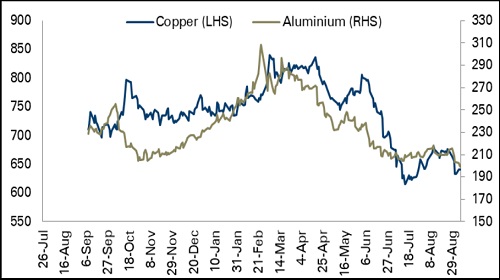

Base Metal Outlook

• MCX copper prices traded flat yesterday despite expectations of better metals demand after Chinese policymakers said they would accelerate infrastructure investment

• Further, copper prices were supported as copper output in July fell 6.6% YoY to 195,234 tones after two of the country's largest mines underperformed

• We expect copper prices to trade with a positive bias for the day amid expectation of infrastructure investment from the Chinese government

MCX Copper vs. Aluminum Performance

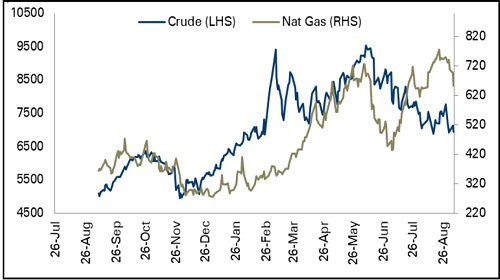

Energy Outlook

• MCX crude oil prices fell on Tuesday as concerns returned about the prospect of more interest rate hikes and Covid-19 lockdowns weakening fuel demand

• However, the Organization of Petroleum Exporting Countries and allies led by Russia, known as Opec+, decided on Monday to cut their October output target by 100,000 barrels per day, prevented further downside

• We expect MCX crude oil prices to trade with a negative bias for the day on expectations of aggressive interest rate hike may dent fuel demand

MCX Crude Oil vs. Natural Gas Performance

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer