MCX copper prices dropped yesterday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Comex gold prices tumbled more than 2.00% yesterday and touched their 28-month low amid strong macroeconomic data from the US and elevated bond yields • The number of Americans filing new claims for unemployment benefits declined to 213,000 in the week ended September 10, well below market expectations of 226,000

• Further, a sharp rise in US treasury yields especially short-term yields pressurised bullion prices

• MCX gold prices are expected to trade with a negative bias for the day amid a rise in US 10 years bond yields. It is likely to trade below | 49,400 and may test 48,900 in coming sessions

Base Metal Outlook

• MCX copper prices dropped yesterday amid a rise in copper LME warehouse inventories

• Aluminium prices gained on Thursday as Europe continued to grapple with a power crisis that has curtailed production of the energy-intensive metal

• We expect aluminium prices to trade with a positive bias for the day as a rising power crisis in Europe may hamper aluminium production

• Additionally, investors will closely watch a series of Chinese economic data

Energy Outlook

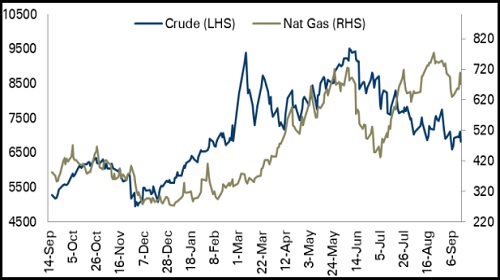

• MCX crude oil prices edged lower by almost 4.00% on Thursday on a tentative agreement that would avert a US rail strike and expectations of weaker global demand

• MCX natural gas prices fell by 5.28% amid an increase in US natural gas storage by 77 Bcf from the previous week

• We expect MCX natural gas prices to trade with a negative bias for the day amid a possible deal that would avert a rail strike, as two-thirds of the US coal-fired power plants receive their coal by rail. When coal or any other fuel is not available for power generation, energy firms usually burn more gas to produce power. This will increase demand for natural gas

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer