MCX copper prices closed on a positive note amid a rise in risk appetite in global markets - ICICI Direct

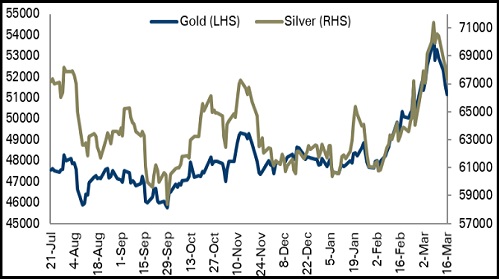

Bullion Outlook

MCX gold prices fell further amid a rise in risk appetite in the global markets and surge in US treasury yields. Gold is highly sensitive to raising interest rates as it increases the opportunity cost of holding non-yielding bullion. Further, demand for safe haven asset dented on hopes of progress in Russia-Ukraine talks. Yields are rising on bet that Russia invasion of Ukraine will not hamper the Feds plan of tightening monetary policy. US Federal Reserve has raised its benchmark interest rates by 25 bps to fight soaring inflation

Gold is likely to continue its negative bias for the day amid a firm dollar and surge in US treasury yields. Yields are rising as the Fed said they would raise their benchmark interest rate by 25 bps to a range between 0.25% and 0.5% from near zero. Further, he Fed also signalled it could soon announce and implement a plan to shrink its $9 trillion asset portfolio. As per FOMC economic projections official expect Fed rate to rise to at least 1.9% by the end of this year, implying total seven quarter-percentage point increases

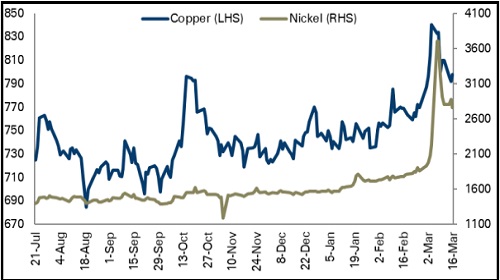

Base Metal Outlook

MCX copper prices closed on a positive note amid a rise in risk appetite in global markets. Prospects of peace talks between Russia and Ukraine along with Chinese stimulus hopes lifted stock markets. China’s Vice Premier Liu He said Beijing will roll out more measures to boost Chinese economy as well as favourable policy steps for capital markets. However, sharp upside was capped as investors remained vigilant ahead of the Fed’s monetary policy meeting as the central bank is facing complicated environment of tight labour market, supply disruptions, spiralling inflation and Russia’s invasion of Ukraine

Industrial metal prices are expected to trade with a negative bias for the day on firm dollar and anticipation of disappointing economic data from US. Further, the Fed decided to end its era of easy money and raise interest rates for the first time since 2018. The Fed decided to raise interest rate by 25 bps and pencilled in a series of further increases this year aimed at controlling elevated inflation. Raising rates restrains spending

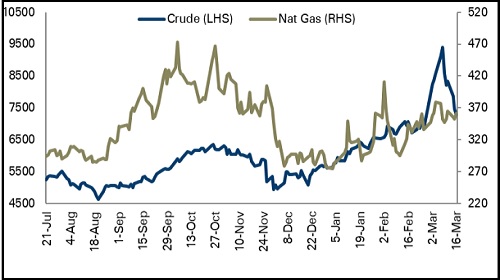

Energy Outlook

Crude oil prices bounced between gains and losses as concern over supply disruption eased on hopes of progress in peace talk between Russia and Ukraine. Further, US oil stockpiles rose more than expected. Crude oil inventories rose 4.345 mn barrels last week compared to expectation for draw of 1.375 mn barrels

Meanwhile, IEA said 3 million (mn) barrels per day of Russian oil and products may not find their way to market beginning April in the wake of invasion of Ukraine. Fears over slowing down of demand in China were relieved as figures showed fewer cases

Crude oil is expected to trade with a negative bias for the day as signs of progress in Russia-Ukraine peace talks will weigh on prices. Further, rise in US stockpiles will add further pressure on prices. Additionally, IEA lowered its forecast for the full year by 950,000bpd to 2.1 million bpd for an average of 99.7 million bpd. This would be a third year of demand below pre-pandemic levels. However, sharp downside may be cushioned on hopes of stimulus from China

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer