MCX Lead futures initially traded sideways during the July month and August month - Choice Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Lead

MCX Lead futures initially traded sideways during the July month and August month so far owing to falling demand in the Asian countries due to rise in covid-19 cases including Japan. However, prices witnessed a some pull back in the second half of July and during the August month so far owing positive industrial data reported in U.S. and European Union. US Federal Reserve and other central banks so far in the last month kept interest rates unchanged. By 9th August, MCX Lead prices closed at Rs.177.25/kg, similar compared to closing of Rs.177.65/kg reported on 1stJuly. Looking forward for the coming month, we expect MCX Lead futures to trade bullish from the lower levels again with improved industrial usage with reports of fall in LME inventories. Rise in cancelled warrants have also indicated greater buying in the global market to support prices. Although worries continue to loom regarding rising dollar index with cases rising once again in China that has led to semi lockdown situation. However, the US and European markets are showing recovery with faster vaccination process and recent positive data of non farm employment rate of the US is indicating further recoveries that is expected to support industrial usage for base metals. As per International Lead and Zinc study Group (ILZSG), global refined lead production for the month of May’21 has reported at 1050.8 thousand metric tonnes(MT), higher by 4.86% compared to previous month's production of 1002.1 thousand metric tonnes. On the other hand, metal usage during May’21 has been reported at 1018 thousand tonnes, higher by 2.33% compared to previous month's usage of 994.8 thousand tonnes. Although the data of is the earlier months, but then, mining activities in South America is expected to decline due to local issues prevailing in Peru and Mexico countries that could create supply tightness in the global markets. Hence, we expect bullish trend in MCX Lead futures for the month ahead.

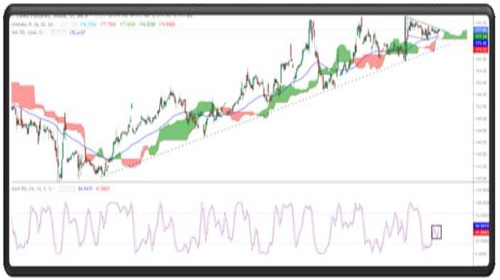

On the daily chart, MCX Lead (Aug) future has been rising continuously in a bullish trend with Higher Highs and Higher Lows formation from the last couple of weeks. The Price has formed a Bullish Flag Pattern which indicates a continued bullish trend. In addition, on the daily chart, the price has also taken Support of the 50 Exponential Moving Averages with Hammer candlesticks which confirms the continued bullish trend. Moreover, the price is trading above Ichimoku cloud, which point-out positive trend for near future. Moreover, an oscillator Stochastic RSI suggested also positive crossover, which is again an upside confirmation. Hence, based on above technical structure one can initiate a long position in MCX Lead (Aug) future at CMP 177.60 or a fall in the price till 176.80 levels can be used as buying opportunity for the upside target of 186 . However, the bullish view will be negated if MCX Lead (Aug) future close below the support level of 172.

Chana

NCDEX Chana Future prices had traded sideways during the July month and August month so far, closing at Rs.5080/quintal by 9th August. It is slightly higher by 1.09% compared to Rs.5025/quintal reported on 30th June. Earlier in July month prices had witnessed downside movement due to stock limit imposed by the central government of India on all major pulses including Desi Chana. However, the central government had lifted up the stock limit later in the same month after price concerns received from the traders, farmers and wholesalers in various spot markets in India. Fundamentally for the month ahead, NCDEX Chana futures is estimated to witness bullish trend as we are approaching the festive season of India. This is expected to further improve the demand for basan and Chana dal in the coming weeks with easing lockdown situation. With improved demand the arrivals and Supplies is expected to improve in the major spot markets of Bikaner and Delhi. Sentiments of Kharif pulses continue to impact Chana prices as well as the overall former sowing continue to lag behind by 3-5% with reports of crop damage in various states mainly Madhya Pradesh and Maharashtra. Maharashtra is the worst affected state and districts like Raigad and Ratnagiri (Konkan region), Kolhapur & Satara are still facing issue of water logging. Farmers in Nanded and Sholapur too are facing excess water problem. Farmers are going for re-sowing in some regions in the said states due to floods which were earlier witnessed in the last week. Elsewhere in Australia and Canada are in the growth phase of Chickpea and based on recent report by Pulses Australia (PA) area is forecasted to increase by 11% to 5.65 lakh hectares with production estimate 6.62 LMT.

On aweekly chart, NCDEX Chana (Sep) future has been trading in sideways to bullish channel from last few week. The price has reversed from Lower trend line with Bullish Engulfing candlesticks which confirm further reversal in the counter. In addition, Chana has given breakout of Falling wedge pattern and the price has shifted above the 21 Exponential Moving Averages which confirms bullish trend in the near term. Moreover, the price is trading above Ichimoku cloud, which point-out positive trend for near future. Furthermore, an oscillator Stochastic RSI is also supportive for the long position with positive crossover. Hence, based on above technical structure one can initiate a long position in NCDEX Chana (Sep) future at CMP 5020 or a fall in the price till 4970 levels can be used as buying opportunity for the upside target of 5530 . However, the bullish view will be negated if NCDEX Chana (Sep) future close below the support level of 4750.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Above views are of the author and not of the website kindly read disclaimer