MCX Gold has broken the 5 session`s winning streak - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

GLOBAL MARKET ROUND UP

* Hawkish comments from central bankers saw bonds fall and the dollar strengthens. This weighed on sentiment across the commodity complex, with most sectors ending the session in the red.

* Gold edge lower amid further hawkish comments from the Fed. James Ballard called for the Fed to raise rates to at least 5.00–5.25%, calling it a minimum level of ‘sufficiently restrictive’. He also showed charts highlighting that a rate as high as 7% could be needed to fight inflation.

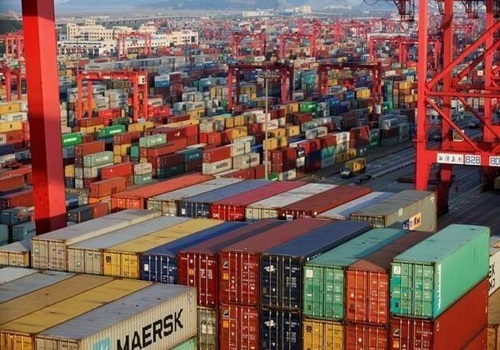

* The selloff in crude oil continued as demand concerns resurfaced. Despite appearing to ease its virus quarantine rules, China is battling another large outbreak affecting some of the country’s most significant cities. The market has also shrugged off geopolitical headlines, from a missile landing in Poland to an oil tanker attack in the Middle East. Oil traders are grappling with surging shipping costs. Ships on the US-China route now cost USD15m, the most since April 2020.

* Base metals were lower as a stronger USD added to demand concerns. Erratic trading conditions continued in the nickel market. Following a 10% rally earlier this week, prices fell sharply despite supply disruptions emerging.

Commodity Daily| BULLION

After two days of running correction, U.S Gold is trading slightly up in today’s session, as the metal’s safe-haven demand diminished on waning fears of an escalation in the Russia-Ukraine conflict. From the bottom of 1615, Comex Gold rose towards 1796 in a short span of time. A range of $1730- $1735 has become a strong base for gold. Bullion prices also saw an element of profit-taking after strong gains in four of the past five sessions, and still traded near a three-month high. In the United States, a gauge of manufacturing activity in the U.S. mid-Atlantic region fell unexpectedly this month to its lowest level since 2011 as firms reported continued softness in new orders and a weak outlook.

Trading Strategy: MCX Gold has broken the 5 session’s winning streak and closed with a minor loss of 0.4%. MCX Silver Dec Fut broke below 8 session low with a loss of 1.64%. Support for the Gold Dec fut is seen at 52600 odd levels, below which it could extend the correction. A level of 53200 has become short term resistance for the MCX Gold December Future.

Commodity Daily| ENERGY

Oil was poised for a weekly loss of more than 7% as concerns over a worsening demand outlook filtered through the crude market. Demand for winter-delivery crude cargoes has slipped from Singapore to Houston, while the forward curve for both major benchmarks has weakened in a sign that supplies are ampler. West Texas Intermediate edged higher above $82 a barrel on Friday, but futures are down for a second week. Oil is trading near the lowest level since September as concerns over China’s swelling Covid cases and aggressive monetary tightening from major central banks weigh on the demand outlook.

Trading Strategy: MCX crude oil Dec fut is expected to show lower level buying in today’s trade but the overall trend remains bearish following double top formation at 7700. It has resistance at 6870 and support at 6610. MCX Natural Gas is having resistance at 540 and support at 500.

Commodity Daily| BASE METALS

The reason behind the fall has been continued concerns over slowing economic growth in major consumer China. Copper remained under pressure by fears that a new COVID-19 outbreak in China will further dent economic activity. Weaker-than-expected economic readings from China this notion, as the country, grapples with its worst COVID-19 outbreak in six months. This has largely offset signs of tightening copper supply, caused by disruptions in major producers Chile and Peru.

Trading Strategy: MCX Copper price fell for the fourth consecutive session to close with a fall of 1.34%. MCX Copper broke down below the crucial support of 685 and closed below that in yesterday’s session. Next support for the underlying is seen at 675.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer