MCX Aluminium prices gained 2.44% on Friday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

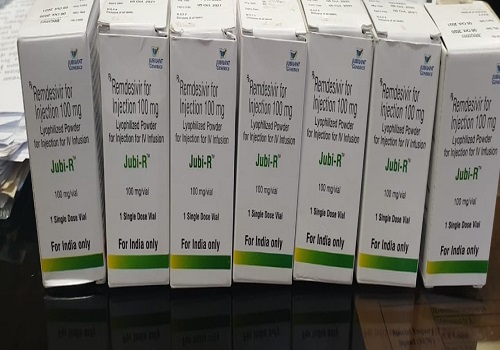

Comex Gold prices declined 0.77% on Friday amid stronger dollar and hawkish statements from Federal Reserve officials. Fed Governor Christopher Waller and Vice Chair Clarida called for increasing pace of winding down bond purchases, making way for possible rate hike

Further, US jobless claims data strengthened bets for an earlier than expected rate hike by the Federal Reserve following recent surge in US inflation and better retail sales data from US

MCX gold prices are likely trade in a range of | 48,600 to 49,100 levels with negative bias on the back of stronger dollar and expectation of early rate hike from Federal Reserve. However, sharp downside may be prevented on worries over rising Covid cases in Europe and concerns over higher inflation

Base Metal Outlook

MCX Aluminium prices gained 2.44% on Friday after explosion at a aluminium plant in China raised fears about tighter supplies. Further, decline in LME Inventories boosted the aluminium prices

An aluminium plant in China's Yunnan province with annual capacity of 300,000 tonnes has stopped production after an explosion on Thursday evening

Aluminium stocks in LME registered warehouses were at 948,650 tonnes, lowest since 2018. The premium of LME cash aluminium over the three-month contract increased to $17 a tonne, suggesting tightening nearby supplies

MCX Aluminium prices are likely trade in a range of | 208 to 216 levels with positive bias due to supply disruptions and fall in LME inventories. However, sharp upside may be prevented on strong dollar

Energy Outlook

US crude oil prices declined by 3.49% on Friday on the back of stronger dollar and on worries that renewed Covid-19 restrictions in Europe may hurt demand

According to the Commodity Futures Trading Commission (CFTC) released on Friday, money managers reduced their net long position in crude contracts by 33,527 to 320,280 over the last week, indicating bearish sentiment in the crude oil market

US natural gas futures rose 3.6% on Friday amid colder weather forecast in US, record high liquefied natural gas LNG exports from US

MCX crude oil prices are likely trade in range of | 5,500-5750 levels with a negative bias due to a strong dollar, higher oil supply and demand concerns. Further, Japan is considering releasing oil from its reserves for the first time, which may put pressure on oil prices

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer