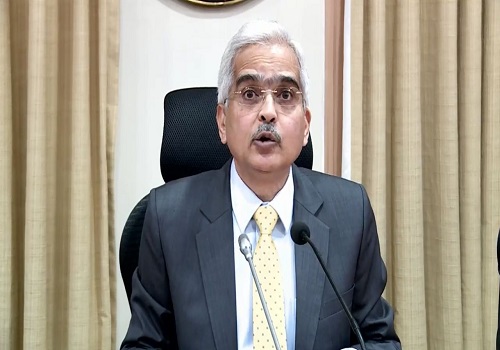

Lenders to communicate to borrowers on loan EMI reset: RBI Governor

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has decided to bring in greater transparency in resetting of the interest rate on equated monthly instalments (EMI) for floating interest loans, Governor Shaktikanta Das said on Thursday.

Announcing the decisions of the MPC, Das said: “It is proposed to put in place a transparent framework for reset of interest rates on floating interest loans.

"The framework will require Regulated Entities to (i) clearly communicate with borrowers for resetting the tenor and/or EMI; (ii) provide options for switching to fixed rate loans or foreclosure of loans; (iii) disclose various charges incidental to the exercise of the options; and (iv) ensure proper communication of key information to borrowers."

These measures will further strengthen consumer protection, he added.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings