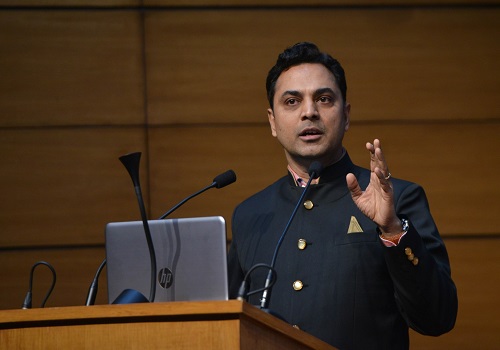

LIC IPO to bring in Rs 1L cr, BPCL sale may fetch Rs 80k cr: CEA K.V. Subramanian

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The much-anticipated initial public offering (IPO) of Life Insurance Corporation of India (LIC) can bring in Rs 1 lakh crore for the government, said the Chief Economic Adviser (CEA) K.V. Subramanian.

Speaking at a webinar on Saturday, the CEA said that the strategic sale of Bharat Petroleum Corporate Ltd (BPCL) is likely to bring in Rs 75,000-80,000 crore.

He was of the view that the disinvestment target of Rs 1.75 lakh crore for the financial year 2021-22 was "imminently achievable".

Talking of the disinvestment target for the current fiscal, Subramanian said: "Of this, BPCL privatisation and LIC listing itself were important contributors. There are estimates suggesting Rs 75,000-80,000 crore or even higher can just come from the privatisation of BPCL itself. LIC IPO could bring in Rs 1 lakh crore approximately."

Both the privatisation of BPCL and IPO of LIC were initially targeted to be completed within the current fiscal, which did not complete amid the pandemic.

During the Union Budget presentation for FY21, Finance Minister Nirmala Sitharaman announced that the all the previously announced disinvestment processes will be completed in the next fiscal.

The LIC IPO is expected to come in around October-November this year.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">