Key News - Sugar companies, Air India, Renewable energy firm, Tata Motors Ltd, Zee Entertainment Enterprises Ltd By ARETE Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Key News

Sugar companies likely to witness 5-7% revenue growth in FY'22: Report

Sugar companies' revenue is likely to grow by 5-7 per cent in 2021-22, following firm domestic and global prices and expected growth in both sugar exports and ethanol volumes, according to a report. On the back of favourable pricing environments domestically and globally as well as increased share of ethanol in revenue mix, the revenues of a sample of sugar companies are expected to grow by 5-7 per cent in FY22 on a yearon-year basis, Icra said in a report.

Air India sale kicks off privatisation drive, next up LIC listing: Official

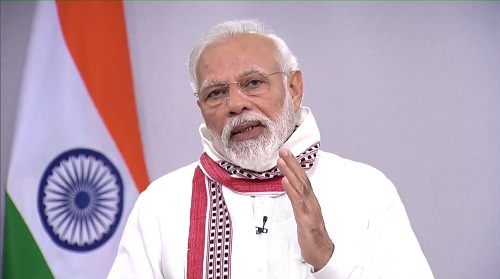

The sale of national carrier Air India to conglomerate Tatas has opened the way for faster privatisation of state firms and the government is on track to list Life Insurance Corporation (LIC) early next year, a top government official said on Tuesday. Tuhin Kanta Pandey, spearheading the drive to sell state enterprises or shut them down, said the government hoped to complete the valuation exercise of LIC by November-December before filing the draft red herring prospectus for the IPO planned by March. Prime Minister Narendra Modi's government is trying to reinvigorate the economy after its deepest contraction in decades through market-oriented changes and hoping to lure investment away from China and other countries.

ReNew expects to commission 10.2 GW renewable energy capacity by FY23

Renewable energy firm ReNew Power is looking to commission its 10.2 gigawatt (GW) capacity by financial year 2022-23. In a statement on Tuesday, ReNew said it also expects to generate an annual EBITDA (earnings before interest, taxes, depreciation, and amortization) of USD 1.1-1.2 billion with the commissioning of the 10.2 GW capacity. "ReNew expects to have its 10.2 GW portfolio operational by the end of FY23 which also includes 3.8 GW of committed capacity i.e. which has a PPA/LOA (Power Purchase Agreements/Letter of Award) or for which the company has a binding acquisition agreement

Tata Motors to raise Rs 7,500 cr from TPG, ADQ for electric vehicle unit

In a major boost to its EV push, Tata Motors on Tuesday closed a deal to raise Rs 7,500 crore from TPG Rise Climate and Abu Dhabi’s ADQ . This is the first major fundraising by an Indian carmaker to push clean mobility. The investment will be in a newly formed subsidiary that Tata Motors has formed for EV business. The Rs 7,500 crore (close to $1 billion) will give a stake of 11-15 per cent stake to TPG-ADQ combine in this subsidiary. Bank of America was the advisor to TPG Rise Climate and Morgan Stanley and JP Morgan have advised Tata Motors’ new EV Unit.

Invesco pushed large Indian group's 'bad' deal: Zee Entertainment

Zee Entertainment Enterprises (ZEEL) on Tuesday revealed that one of its shareholders, Invesco, had approached its managing director and chief executive officer, Punit Goenka, with a merger proposal in February on behalf of a rival company, part of a large Indian business group, which, if accepted, would have led to a loss of Rs 10,000 crore for the company's shareholders. In a communication to the stock exchanges, ZEEL said Goenka informed the board that a merger deal was presented by Invesco’s representatives Aroon Balani and Bhavtosh Vajpayee in February, which involved the merger of ZEEL with certain entities owned by a large Indian group. bank.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer