Kedia Advisory Diwali Equity Picks 2020 By Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Equity Markets have recorded a hiĀhly volatile but stellar perÿormance this year. Niÿty 50 Index recorded a 6.02% YOY Ārowth. Niÿty touched it's all-time hiĀh oÿ 12643.90 on the 10th oÿ November. This year Niÿty also had seen a sharp ÿall till levels oÿ 7511.10 when Covid 19 panic started spreadinĀ. India Vix also touched it's all-time hiĀh this year. But markets have recovered sharply since due to various steps taken by RBI and the Government oÿ India. The Āovernment injected liquidity oÿ approximately 10% oÿ the size oÿ GDP which helped keep the economy and markets afloat. With ÿallinĀ coronavirus cases in India and the openinĀ up oÿ the economy, we expect an incredible year cominĀ. In our Diwali Picks oÿ 2020, we have selected a ÿew companies to help you make your investments. To keep risk profile to a minimum we have prepared a diversified list oÿ stocks with sound ÿundamentals to choose ÿrom

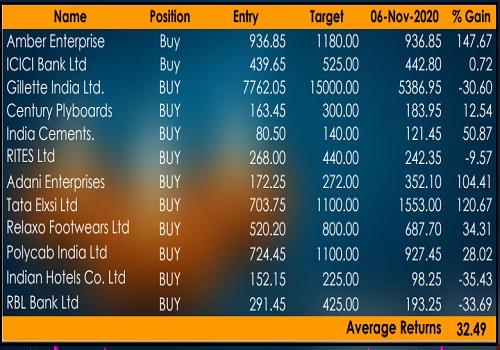

Diwali 2019 Performance

Diwali 2020 Picks Samvat 2077

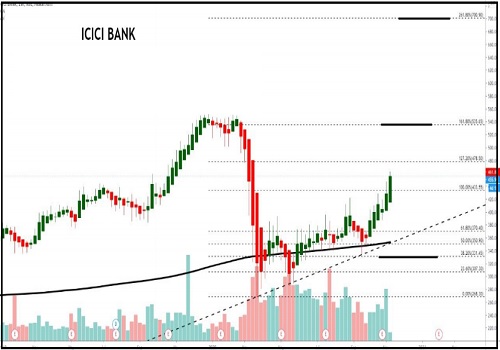

ICICI Bank

* Stocks in PE Buy Zone with Reasonable Durability Score, and Rising Momentum Score

* Rising Net Cash Flow and Cash from Operating activity

* Company with high TTM EPS Growth

* Strong Annual EPS Growth

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

Bharti Airtel

* Stocks where Mutual Funds Increased Holdings in Past Month

* Increasing Revenue every Quarter for the past 8 Quarters

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Increasing Revenue every Quarter for the past 4 Quarters

* Company with Zero Promoter Pledge

* FII / FPI or Institutions increasing their shareholding

* Growth in Operating Profit with increase in operating margins (YoY)

State Bank Of India

* Stocks in PE Buy Zone with Reasonable Durability Score, and Rising Momentum Score

* Growth Factor Screener: Rising returns on equity (ROE), Momentum, and Earnings

* Company with high TTM EPS Growth

* Strong Annual EPS Growth

* Effectively using Shareholders fund - Return on equity (ROE) improving since last 2 years.

* Efficient in managing Assets to generate Profits - ROA improving since last 2 year

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

SBI Life

* Stocks where Mutual Funds Increased Holdings in Past Month

* Rising Net Cash Flow and Cash from Operating activity

* Company with high TTM EPS Growth

* Good quarterly growth in the recent results

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Company with No Debt

* Strong cash generating ability from core business

* Annual Net Profits improving for last 2 years

* Book Value per share Improving for last 2 years

Larens and Turbro

* Rising Net Cash Flow and Cash from Operating activity

* Company with high TTM EPS Growth

* Strong QoQ EPS Growth in recent results

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Strong cash generating ability from core business

* Annual Net Profits improving for last 2 years

Britania

* Stocks with Consistent Share Price Growth

* Company with high TTM EPS Growth

* Stocks with improving cash flow, with good durability

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Company with Low Debt

* Annual Net Profits improving for last 2 years

* Company with Zero Promoter Pledge

* FII / FPI or Institutions increasing their shareholding

* Growth in Operating Profit with increase in operating margins (YoY)

Infosys

* Consistent Highest Return Stocks over Five Years

* Increasing Revenue every Quarter for the past 8 Quarters

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Company with No Debt

* Increasing Revenue every Quarter for the past 4 Quarters

* Strong cash generating ability from core business

* Company with Zero Promoter Pledge

* FII / FPI or Institutions increasing their shareholding

* Growth in Operating Profit with increase in operating margins (YoY)

Ultra Tech Cement

* Growth Factor Screener: Rising returns on equity (ROE), Momentum, and Earnings Yield

* Company with high TTM EPS Growth

* Strong Annual EPS Growth

* Strong QoQ EPS Growth in recent results

* Effectively using Shareholders fund - Return on equity (ROE) improving since last 2 year

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Company reducing Debt

* Strong cash generating ability from core business

Dr Reddy

* Stocks where Mutual Funds Increased Holdings in Past Month

* Consistent Highest Return Stocks over Five Years

* Efficient in managing Assets to generate Profits - ROA improving since last 2 year

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Company with Low Debt

* Strong cash generating ability from core business

* Company able to generate Net Cash - Improving Net Cash Flow for last 2 years

* Annual Net Profits improving for last 2 years

HCL Technologies

* Stocks where Mutual Funds Increased Holdings in Past Month

* Consistent Highest Return Stocks over Five Years

* Growth in Net Profit with increasing Profit Margin (QoQ)

* Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

* Company with Low Debt

* Strong cash generating ability from core business

* Annual Net Profits improving for last 2 years

* Company with Zero Promoter Pledge

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">