June Series Rollover Note : July has positive track record but Shorts with higher volatility indicating speed breaker ahead By Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty started the series on a negative note overpowered by weak global cues and remained overshadowed by the bears for the first half of the series. The second half of the month witnessed a base formation near 15200 zones followed by a pullback move of around 750 points. The last week of the series was packed with the comeback of bulls and recovery with buying seen at lower zones. However volatility is consistently shifting higher indicating some sort of capped upside as the index failed to surpass psychological 16000 zones. It concluded the June expiry near 15780 levels and formed a Bearish candle with longer shadows on either side indicating wild swings and has been forming lower highs - lower lows from the last two series (expiry to expiry chart).

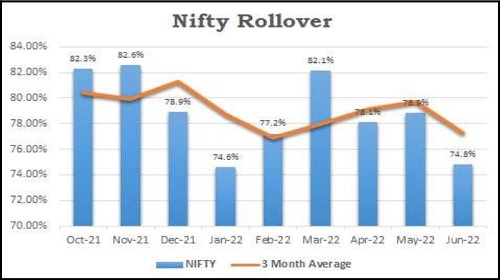

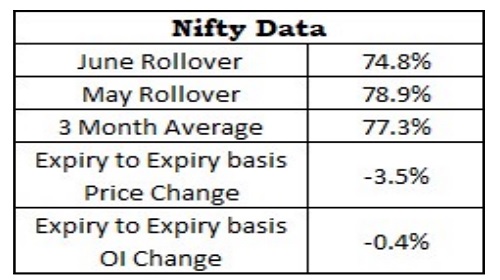

The open interest activity in Nifty has marginally decreased by 0.40% in the series with a price fall by 3.50% on an expiry-toexpiry basis. Rollover of Nifty stood at 74.81%, which is lower than its quarterly average of 77.27%. Long liquidation was seen in the index and overall mixed sentiments ruled the month with tug of war to still continue with downside cushioned as multiple support seen at lower zones and restricted upside.

Nifty Rollover

Nifty Data

On Option front, since it is the beginning of new series, OI inventory is scattered at various far strikes. Maximum Call OI is at 17000 then 16500 strike while Maximum Put OI is at 15000 then 15500 strike. Marginal Call writing is seen at 16000 then 16500 strike while Put writing is seen at 15500 then 15700 strike. Option data suggests a broader trading range in between 15300 to 16300 zones.

Nifty closed near 15780 zones and At The Money Straddle (July Monthly 15800 Call and 15800 Put) is trading at net premium of around 750 Points, giving a broader range of 15050 to 16550 levels. Considering overall derivatives activity, we are expecting some follow up action for Nifty to witness some bounce but upside hurdles are intact due to relentless FIIs selling and pressure form the global bourses. Now it has to hold above 15735 zones for an up move towards 16000 and 16350 zones whereas on the downside support is intact at 15555 and 15350 zones.

Nifty index witnessed selling pressure in most of the sectors in the month of June. However positive momentum was only seen in Auto space while weakness was seen in most of the sectors such as Metals, IT, PSU Banks, Energy, Pharma, FMCG and Media.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Top News

GAIL (India) rises on the BSE

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Quote on Morning market 01st November 2021 By Dr. V K Vijayakumar, Geojit Financial