`Industry Experts Hail India`s Economic Survey 2023: A Bright Spot Despite Global Headwinds`

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Union Budget 2023-24 started with the tabling of the Economic Survey 2023 by Finance Minister Nirmala Sitharaman. The survey presents a positive outlook for India's economy.

India's economy is projected to grow at 6.5 per cent in 2023-24 as compared to 7 per cent this fiscal and 8.7 per cent in 2021-22. The Real GDP growth is expected to be in the range of 6-6.8 per cent in the next fiscal.

India is considered the third largest economy in PPP (purchasing power parity) terms and the fifth largest in exchange rate terms. The RBI's projection of 6.8% inflation for this fiscal is not considered high enough to deter private consumption but not too low to weaken investment. The borrowing cost may remain 'higher for longer' due to entrenched inflation.

Mr. Manish Chowdhury, Head of Research at Stoxbox, believes that, “India is projected to log the fastest growth rate among major global economies, at 6-6.8%. He cites structural factors like PLIs, FTAs, alternate technologies/fuels, domestic demand, and healthy balance sheets of consumers, corporates, and banks as factors that would propel economic growth in the long term.”

The Economic Survey also warns of the challenge to rupee depreciation, which may increase if the Current Account Deficit (CAD) continues to widen. India has sufficient forex reserves to finance its CAD and intervene in the forex market. The growth in exports has moderated in the second half of the current fiscal and the Bank credit growth is likely to be brisk in FY24.

“The Economic Survey outcome seems positive for the market with the upgrade in FY23 GDP growth expectation and the FY24 inflation within the RBI's targeted range providing relief. However, the FY24 GDP growth of 6-6.8% is below the desired 7% range. The preference for growth over fiscal deficit is expected to be a key trigger for market sentiment", said Mr. Mitul Shah, Head of Research at Reliance Securities.

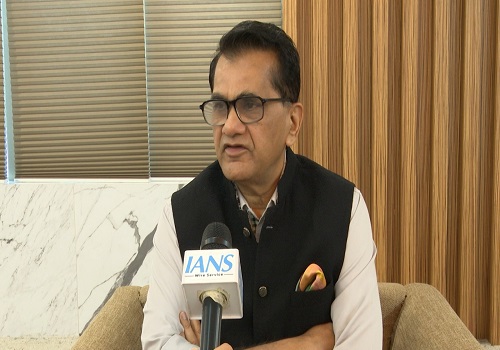

Mr. Narinder Wadhwa, President of CPAI, further states that, “the digitalisation reforms and the resulting efficiency gains in terms of greater formalisation, higher financial inclusion, and more economic opportunities will be the second most important driver of India’s economic

growth. Enhancing productivity in agriculture & performance very positive for capital and commodities markets”.

“The Economic Survey shows that the economy is on the way to recovery post the pandemic. Despite the geopolitical risks and the financial shocks to the economy on account of monetary tightening, the economy has a positive growth outlook in the medium term”, said Amita Vaidya, Director, Sarla Anil Modi School of Economics. NMIMS Mumbai.

Shri Saket Dalmia, President, PHD Chamber, congratulates the government on a quick economic recovery from Pandemic and achieving the Pre-Pandemic economic level in the Current Financial Year 2022-23.

The drivers of economic growth such as solid demand, private investment and capital expansion are performing well above the pre-pandemic levels, said Shri Saket Dalmia.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">