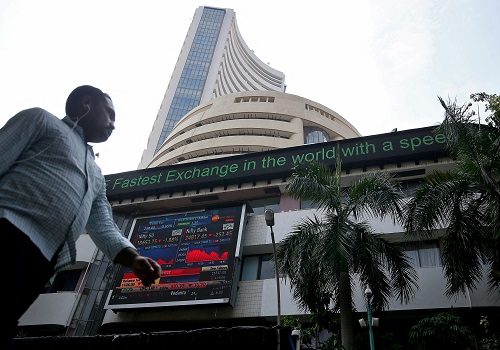

Indian shares may open lower on caution over US debt ceiling talks

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian shares are set for a subdued start on Monday, tracking a slide in global equities ahead of the resumption of debt ceiling talks in the United States, which paused on Friday.

India's NSE stock futures listed on the Singapore exchange were down 0.16% at 18,208, as of 8:05 a.m. IST.

Wall Street equities closed lower on Friday on reports that the U.S. debt ceiling negotiations had reached an impasse. A failure to lift the debt ceiling would trigger a default and a spike in interest rates, analysts cautioned. Asian markets were mixed. [MKTS/GLOB]

Indian shares snapped three straight sessions of losses on Friday, aided by quarterly earnings and persistent foreign institutional buying. Analysts expect the Nifty benchmark to consolidate in the 18,050-18,450 range.

"The short-term trend for the Nifty remains choppy," said Nagaraj Shetti, technical research analyst at HDFC Securities.

"The emergence of buying interest on Friday raises hopes for an upside bounce in the market."

Foreign institutional investors (FIIs) snapped a 16-session buying streak on Friday, selling 1.13 billion rupees ($13.8 million) of shares, provisional data from the National Stock Exchange showed.

"The overall mood in the markets in the near term will be decided by FII flows and developments on the U.S. debt default situation," said Deepak Jasani, head of retail research at HDFC Securities.

Stocks to Watch:

** Zomato Ltd: Co misses Q4 revenue expectations on higher strategic expenses.

** Power Grid Corporation of India Ltd: Co reports rise in fourth-quarter profit on increase in demand.

** Bandhan Bank Ltd: Co posts fall in March-quarter net profit.

** NTPC Ltd: Co reports fall in fourth-quarter profit as expenses outweigh power demand.

($1 = 81.7800 Indian rupees)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">