Indian shares drop on U.S. inflation worries; domestic COVID-19 death surge

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BENGALURU (Reuters) - Indian shares slid on Wednesday dragged by losses in private sector banks as global investor mood soured over concerns of a potential pickup in U.S. inflation, while domestic COVID-19 deaths crossed the quarter-million mark.

The NSE Nifty 50 index fell 1.04% to 14,696.50, while the S&P BSE Sensex slid 0.96% to 48,690.80.

Speculation that surging commodity prices and growing inflationary pressure in the United States could lead to earlier rate hikes and higher bond yields globally, sent Asian shares to two-month lows, although U.S. Federal Reserve officials reiterated a firmly dovish policy stance. [MKTS/GLOB]

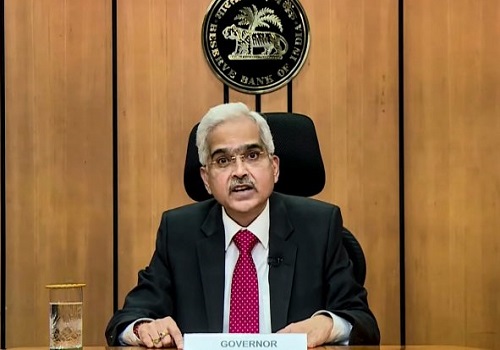

In India, the central bank is seen maintaining status quo on interest rates as data expected later in the day is likely to show retail inflation eased to a three-month low in April. However, investors are concerned about potential outflows of foreign funds.

Adding to investor concerns, India reported a record surge in coronavirus deaths in the past 24 hours, pushing its overall death toll over a quarter million.

Moody's Investors Service warned on Tuesday that the second severe wave of coronavirus infections would slow near-term economic recovery, slashing its real GDP growth forecast to 9.3% from 13.7% for the fiscal year ending March 2022.

On Wednesday, private sector lenders were the top drag. The Nifty private bank index settled 1.6% lower and the Nifty Financial Services index closed down 1.23%.

Tata Steel snapped five straight sessions of gains to close 4.44% lower.

The pandemic continued to hammer sales for the auto sector. India's passenger vehicle sales slumped over 10% month on month, data from the Society of Indian Automobile Manufacturers (SIAM) showed.

Still, the Nifty auto index closed up 0.19%.

(Reporting by Chandini Monnappa in Bengaluru; Editing by Shinjini Ganguli)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">