Indian markets could open flat to mildly higher, following largely positive Asian markets today and higher US markets on Monday - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets could open flat to mildly higher, following largely positive Asian markets today and higher US markets on Monday - HDFC Securities

US stock benchmarks finished at new records Monday, as investors piled into energy stocks and penciled in solid corporate earnings and another potential round of aid spending out of Washington.

Elon Musk’s Tesla Inc. said that it has acquired $1.5 billion in bitcoins in January and that it could accept the world’s No. 1 digital asset for payment in the future. This helped to drive up bitcoin prices to around $44,203, a gain of over 13% in early trade on CoinDesk. In the US, 30 Year Bond yields touched 2% in intra day trading on Monday, an 11 month high.

Oil prices rose 2% to their highest in over a year, with Brent nudging past $60 a barrel, boosted by supply cuts among key producers and hopes for U.S. economic stimulus.

Stocks in Asia-Pacific were mostly higher in Tuesday trade following overnight gains on Wall Street that saw so-called reflation trades around the world in which global markets bid up stocks, cryptocurrencies, oil and gold while U.S.

Treasury yields held near 11-month highs. Indian benchmark equity indices ended higher for the sixth consecutive day on Feb 08. The Nifty opened gap up and then remained sideways through the day. At close the NSE Nifty 50 gained 1.3% to close at 15,115. Nifty marches ahead day after day with minimal intra day correction.

Going by volume numbers it seems that FPIs interest has dipped on Feb 08, the ongoing results season is leading to rotational buying across stocks and sectors which incidentally pulls up the Nifty. On a channel line basis, the next resistance for the Nifty is around 15200 while the support is at 14870-14914.

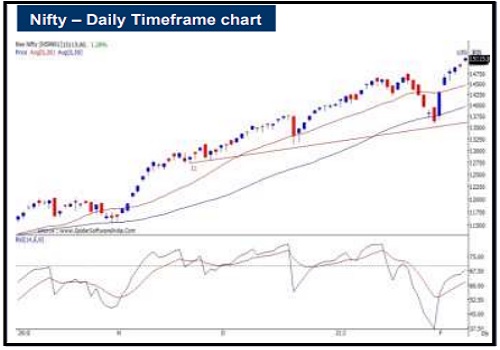

Daily Technical View on Nifty

Observation: Markets ended with hefty gains on Monday as the rally continued post Budget. It was the sixth consecutive session of gains for the Nifty.

The Nifty finally gained 191.55 points or 1.28% to close at 15,115.8. Broad market indices like the BSE Mid Cap and Small Cap indices gained more, thereby out performing the Sensex/Nifty. Market breadth was positive on the BSE/NSE. Sectorally, the top gainers were the BSE Auto, Metal, Telecom and CD indices.

The top loser was the BSE FMCG index. Zooming into the Nifty 15 min charts, we observe that the Nifty opened with an upgap and then traded in a range for the rest of the session with the 20 period MA providing support to the index. With the uptrend intact, we expect the Nifty index to test the 15200 levels in the very near term.

On the daily chart, we can observe that the Nifty has convincingly reversed the recent downtrend by moving up from a trend line support and convincingly closing above the 50 day SMA last Monday. With the upmove continuing, the Nifty now comfortably trades above the 20 day SMA. The index could now attempt to make new life highs in the coming sessions.

It is important that the Nifty does not move below the immediate support of 14864 on any corrections for the short term uptrend to remain intact. We recommend using a selective buying approach and accumulating quality stocks from outperforming sectors. Strict stop losses need to be kept to control risk. Conclusion: The 1-2 day trend of the Nifty remains up with the index surging higher and the index trading above the 50 period MA on the 15 min charts.

Nifty is likely to test the 15200 levels in the very near term. Our 7-day view on the market too remains bullish as the Nifty has convincingly reversed the recent downtrend by moving up from a trend line support and convincingly closing above the 20 day and 50 day SMA. Our bullish bets for the next 7 sessions would be off if the Nifty moves lower and closes below the 14864 levels.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions