Indian bond yields hit five-month high on lack of immediate RBI support

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

MUMBAI - Indian bond yields surged to their highest in more than five months on Friday as traders expressed their disappointment with the Reserve Bank of India for not announcing a concrete bond buyback calendar to absorb additional market borrowing.

The RBI kept rates steady at record low levels, as expected, on Friday and said it would maintain support for the economy's recovery from the pandemic by ensuring ample liquidity for markets.

The government in its budget earlier this week announced an additional borrowing of 800 billion rupees ($10.97 billion) for the current fiscal year to March and said it would borrow 12.06 trillion rupees in 2021/22, much more than the expected 10-11 trillion rupees.

"(The) market expected the RBI to announce some measures to support bond markets in the face of higher borrowings pursuant to an expansionary budget," said Avnish Jain, head of fixed income at Canara Robecco Asset Management Company.

"While the RBI assured that government borrowings are likely to be managed without disruptions, lack of any immediate action led to a market sell-off," he said.

The benchmark 10-year bond yield rose as high as 6.19% after the policy, its highest level since end-August but ended the session at 6.15%, up 5 basis points on the day.

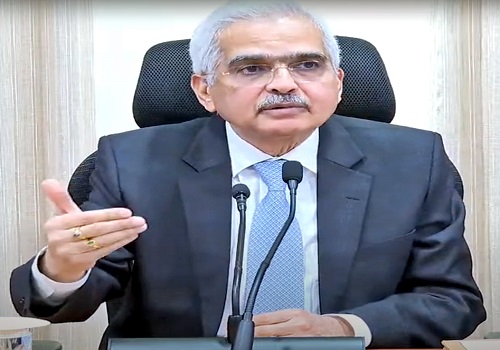

"We are confident of managing (borrowing) it in a non-disruptive and seamless manner," Governor Shakikanta Das told the media, adding that they had done the job well in the current fiscal year too.

Kotak Mahindra Bank said it now expects the 10-year yield to range between 6% and 6.75% over the year, with the lower bound possible only with sustained open market bond purchases by the central bank.

The RBI also said the dispensation offered to banks last year at the peak of the pandemic for maintaining a lower cash reserve ratio until end-March would now be reversed in two phases instead of one.

Deputy Governor Michael Patra, meanwhile, said the money withdrawn through the restoration of CRR will be replenished with more durable liquidity.

The RBI has also decided to allow retail investors a platform to directly participate in the government bond market, in an attempt to widen the investor base.

"Overall, while the policy is dovish, inflation projections continue to remain over 4% in FY2022, indicating that, now, there is no room for easing. The RBI is likely to remain on pause mode for most of FY2022," Jain said.

(Reporting by Swati Bhat; editing by Uttaresh.V)