India VIX index is at 21.36 v/s 19.70 - Axis Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

HIGHLIGHTS

Nifty futures closed at 16895.65 on a negative note with 4.76% increase in open interest indicating Short Build Up.

Nifty Futures closed at a premium of 8 points compared to previous day premium of 9 points.

Bank Nifty futures closed at 38159.15 on a negative note with -0.34% decrease in open interest indicating Long Unwinding.

Bank Nifty Futures closed at a premium of 130 points compared to previous day premium of 175 points.

Bank Nifty Futures closed at a premium of 130 points compared to previous day premium of 175 points.

FII's were Seller in Index Futures to the tune of -1170 and were Buyer in Index Options to the tune of 2412 crores, while they were net Seller in Stock Futures amounting to -2119 crores. FII's were net Sellers in derivative segment to the tune of -1034 crores.

India VIX index is at 21.36 v/s 19.70. Nifty ATM call option IV is currently 20.14 whereas Nifty ATM Put option IV is quoting at 23.02

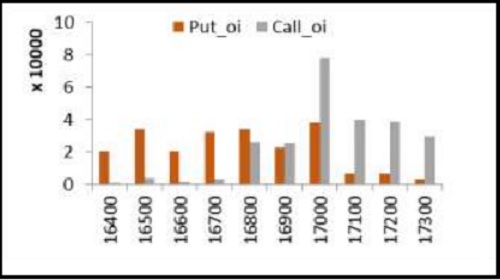

Nifty Options OI Distribution-Weekly

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

More News

Opening Bell : Markets likely to get negative start due to profit booking after recent rally