`In-line` Q4 earnings so far result in EPS base expansion; valuations improve as market consolidates! - ICICI Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

‘In-line’ Q4 earnings so far result in EPS base expansion; valuations improve as market consolidates!

* Q4FY21 result season is largely in-line so far with 26 neutrals, 18 beats and 23 misses. Sales, EBITDA and PAT yoy growth of 15%, 16% and 18% (53% including financials), respectively for NSE 200 universe on a free-float basis.

* Macro cues from Q4 so far – exports (IT, auto), GFCF (cement, metals) and PFCE (staples) are resilient, while PFCE (discretionary consumption) is lagging.

* Health crisis has not spilled over into a wide-spread financial crisis yet as indicated by low spreads in bond markets, absence of large GNPA shocks in financial system and improving government finances.

* Cost pressures rising across the board (WPI inflation at 7.4% in Mar’21) but the ability to mitigate by cost rationalisation, product mix and to pass on the cost is visible.

* Second wave covid impact so far: High frequency indicators in April’21 were mixed with exports sector, PMI-manufacturing and GST collections being robust, but weak mobility data and auto sales.

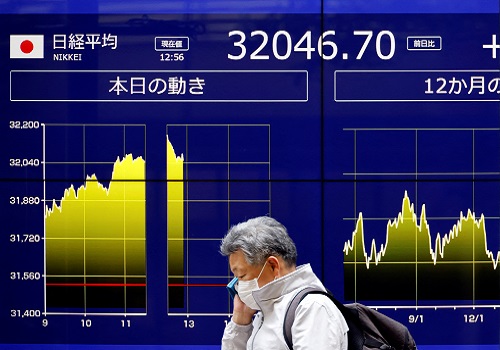

Outlook: Expanding earnings base and consolidating index is improving the ‘time value of money’ (Link to earlier note) as valuations scale down from record levels. Trajectory of covid cases will be a key trigger for the market as India has underperformed global equities since March’21.

Macro cues from Q4: exports and GFCF are positive while consumption is mixed:

* Exports growth is positive and ranges from stable growth for software (2-3% QoQ, CC) to strong revival for auto as global demand improves. Extending the trend from Q4 results, merchandise exports for April rose sharply to US$30bn.

* GFCF (gross fixed capital formation) is less impacted as cement and metal volumes are strong (>15-20% YoY), indicating construction and manufacturing activities are robust, which is further corroborated by robust core sector growth for March’21 (6.8% yoy) driven largely by steel (23% YoY), cement (32.5% YoY) and electricity production (21.6%).

* PMI-manufacturing (55.5) and GST collections (Rs1.41tn) continued to be robust even in covid impacted month of April’21.

* PFCE (private final consumption expenditure) is subdued as discretionary consumption (PVs, leisure, retail, travel & entertainment) continues to be impacted severely by the second wave although demand for staples remain robust.

* Digital channels and formal sector continue to gain market share as unorganised sector has been impacted the most.

Health crisis has not spilled over into a financial crisis yet as indicated by low spreads, absence of large GNPA shocks in banking system and improving government finances.

* No major sign of stress within large banks and NBFCs so far which is reflected in record low spread of corporate bonds over government bond yield which is also being helped by the accommodative stance of RBI.

* Government fiscal deficit position continues to surprise positively with GST collections showing sustained improvement

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7

Above views are of the author and not of the website kindly read disclaimer