IPO Note - Syrma SGS Technology Ltd By Asit C Mehta Investmentz

Syrma SGS Techno Ltd.

Company Background

Incorporated in 2004, Syrma SGS Technology Limited (“Syrma”) is a Chennai-based engineering and design company engaged in electronics manufacturing services (EMS). The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization. Syrma is one of India’s leading exporters of electronics, providing a high-value integrated design and production solution for internationally recognized OEMs. The company operates through eleven manufacturing facilities in north India (i.e. Himachal Pradesh, Haryana, and Uttar Pradesh) and south India (i.e. Tamil Nadu and Karnataka). The manufacturing facilities in Tamil Nadu are located in a special economic zone. The manufacturing facility in Haryana has been set up under the Electronic Hardware Technology Park scheme, which allow the company to avail tax and other benefits. The company has three dedicated R&D facilities, two of which are located at Chennai and Gurgaon and one in Stuttgart, Germany.

Issue Details

The offer comprises Fresh Issue of Equity shares aggregating upto Rs.766Cr and Offer for sale of Equity Shares aggregating upto Rs.74Cr.(The company did a pre-IPO placement at Rs. 290 a few months back).

Issue Objectives

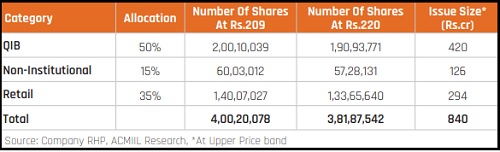

IPO share allotment pattern

Outlook and Valuations

Syrma is one of the leading design and electronic manufacturing services companies in India. It has diversified product portfolio and service offerings. India’s EMS addressable market is expected to grow at a CAGR of 30%, set to reach USD 135 billion by FY26 from Rs.USD 36 billion in FY21. India’s EMS market is expanding owing to the China+1 strategy, import substitution, and government incentives like the PLI. With its superior product mix, strong R&D capabilities, and adding capacities, we believe Syrma is well placed to capitalize on domestic and global opportunities. At the upper price band of Rs.220/-, stock is priced at 50.71x its FY22 EPS of Rs.4.34/-(based on fully diluted post issue equity). We recommend subscribing to the issue from a listing gain perspective.

Competitive Strengths

One of the leading design and electronic manufacturing services companies

Among the large bouquet of EMS players in India, Syrma is one of the fastest growing Indian-headquartered ESDM companies. Further, they are leaders in high mix low volume product management and are present in most industrial verticals. They are a technology-focused engineering and design company engaged in turnkey electronics manufacturing services (“EMS”), specializing in precision manufacturing for diverse end-use industries, including industrial appliances, automotive, healthcare, consumer products and IT industries. Syrma is also amongst the top key global manufacturers of custom RFID tags.

Diversified and continuously evolving and expanding product portfolio and service offerings catering to customers across various industries, backed by strong R&D capabilities

Syrma has, over the years, diversified and expanded their product portfolio. The diversification and expansion of their product portfolio is primarily driven by the continuously evolving needs of their customers and technological advancements in the industry. The evolution of their product portfolio and service offerings have been driven by their R&D capabilities. Company’s strong focus on R&D has helped them increase their wallet share by helping them widen their product offerings to the same customer, and cross selling these products to other customers. Their R&D team also aims to provide solutions to improve of their existing manufacturing processes.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at www.investmentz.com/disclaimer

SEBI Registration number is INZ000186336

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer