IPO Note - Krishna Institute of Medical Sciences Ltd By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

A South India based healthcare group

Krishna Institute of Medical Sciences Ltd. (KIMS) is one of the largest corporate healthcare groups in AP and Telangana in terms of the number of patients treated and treatments offered. They provide multi-disciplinary integrated healthcare services, with a focus on primary secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities. KIMS operate 9 multi-specialty hospitals under the “KIMS Hospitals” brand, with an aggregate bed capacity of 3,064 as of December 31, 2020. The first hospital in the network was established in Nellore (AP) in 2000 and has a capacity of approximately 200 beds.

* Diversified revenues across specialties with focus on Cardiac sciences, Neurosciences, gastric sciences, orthopaedics, renal sciences and interventional pulmonology.

* They experienced a negative CAGR of 3.96% in outpatient volume from FY19 to FY21 mainly due to COVID-19 related lockdown, but were offset by 2.31%CAGR growth of inpatient volume, which resulted in growth of total income.

* Between FY17 and FY20, KIMS have expanded the hospital network primarily through acquisitions and completed four such acquisitions.

* KIM’s revenue grew 20.4% CAGR in FY19-21, while PAT grew from a loss of Rs.50cr in FY19 to Rs.206cr in FY21.

* The Indian healthcare delivery industry is expected to grow at a 17-18% CAGR between FY20 and FY24.

* KIMS plans to expand into markets that are adjacent to the core markets of AP and Telangana, focusing on Karnataka, Tamil Nadu, Odisha and Central India.

* To expand clinical capabilities in existing hospitals to add specialties like organ transplant,Oncology and Mother&child.

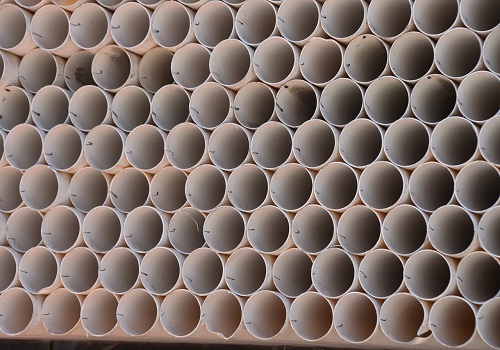

* Bed capacity will be increased by 50% from the current levels and will explore untapped geographies in AP& Telangana in the near future.

* At the upper price band of Rs.825, KIMS is available at EV/EBITDA of 18.6x (FY21) which appears fully priced. We expect to see a recovery in patient footfalls and occupancy rates as lockdown restrictions ease. The company’s leadership position in the AP& Telangana along with expansion into new markets and increased bed capacity will be strong levers for future growth. We assign subscribe rating with a long term perspective.

Purpose of IPO

The offer comprises of fresh issue and offer for sale. The proceeds of the offer for sale shall be received by the selling shareholders. The net proceeds of the fresh issue will be utilized for repayment and/or pre-payment of debt of the Company and one of its Subsidiaries and general corporate purposes.

Key Risks

* The COVID-19 pandemic has affected regular business operations and may continue to do so.

* Around 65% of the group’s revenues are from hospitals in Hyderabad (Telangana).

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Above views are of the author and not of the website kindly read disclaimer

Top News

Texmo Pipes & Products surges on acquiring 51% of equity share capital of Shree Venkatesh In...

Tag News

Trend reversal in FPI investment from buying in last 3 months to selling in Sep