ICICI Lombard inches up on increasing investment in retail health segment

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

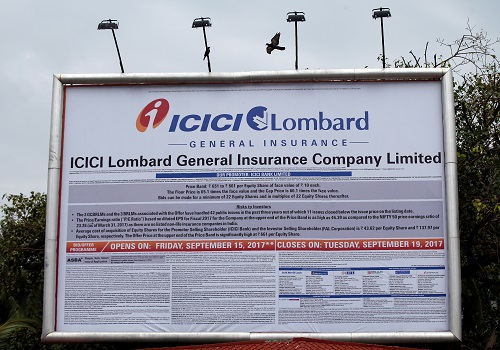

ICICI Lombard General Insurance Company is currently trading at Rs. 1251.30, up by 1.10 points or 0.09% from its previous closing of Rs. 1250.20 on the BSE.

The scrip opened at Rs. 1240.00 and has touched a high and low of Rs. 1255.20 and Rs. 1240.00 respectively. So far 2262 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 10 has touched a 52 week high of Rs. 1674.00 on 22-Sep-2021 and a 52 week low of Rs. 1070.95 on 13-Jun-2022.

Last one week high and low of the scrip stood at Rs. 1282.55 and Rs. 1214.25 respectively. The current market cap of the company is Rs. 61358.73 crore.

The promoters holding in the company stood at 48.04%, while Institutions and Non-Institutions held 40.61% and 11.34% respectively.

ICICI Lombard General Insurance Company (ICICI Lombard) has increased its investment in retail health segment which became the highest contributor to the insurance industry in FY22.

The company's Gross Direct Premium Income (GDPI) stood at Rs 17,977 crore in FY22 (merged) as against Rs 14,003 crore (standalone) in FY21, registering a growth of 28.7 per cent. During the fiscal, the company also completed the process of integration of non-life business of the erstwhile Bharti AXA General Insurance Company with itself. Post the successful integration, ICICI Lombard has become the second largest general insurer in India in terms of GDPI.

ICICI Lombard General Insurance Company offers its customers a comprehensive and well-diversified range of products, including motor, health, crop/weather, fire, personal accident, marine, engineering and liability insurance, through multiple distribution channels.

Tag News

``ICICI Lombard Unveils `Cloud Calling' Feature, Transforming Motor Claims Interaction and A...