Hike in lending rates could impact the gradual recovery seen in the economy Says†Kedar Kadam, Waterfield Advisors

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

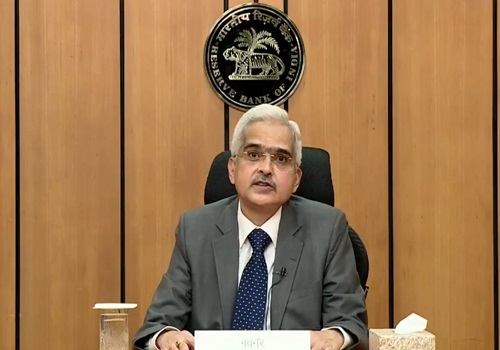

Below is Quote on RBI MPC announcement by Kedar Kadam, Director – Listed Investments, Waterfield Advisors

“In line with the global trend of monetary policy tightening to cool off inflation, RBI hikes repo rate by 0.5 bps, while retaining GDP growth forecast at 7.2%. The Central Bank has so far raised the repo rate by 140 basis points since embarking on a tightening cycle at an unscheduled policy meeting in May this year. The MPC's rate hike is intended at curbing demand, and, thereby, controlling high inflation. Although, much of the risks to inflation are emerging from external factors. We do not expect banks to pass on the current hike in interest rates, as they have already raised the lending rates, further hike in lending rates could impact the gradual recovery seen in the economy in the post-pandemic period”.

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Top News

Natco Pharma gains on signing voluntary licensing agreement with Lilly for Baricitinib for C...

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings