Healthy consolidation amid stock specific activity - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Healthy consolidation amid stock specific activity

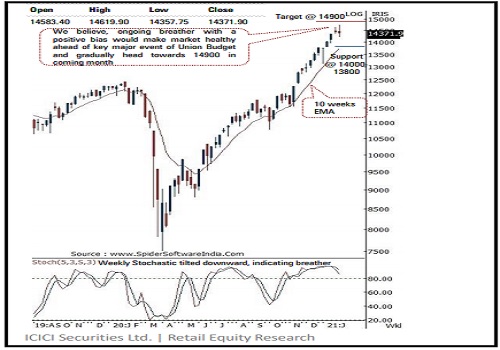

Technical Outlook

* Equity benchmarks witnessed profit booking as the Sensex achieved the psychological mark of 50000 and concluded the highly volatile week on a flat note. The Nifty snapped its three week’s winning streak and closed the week at 14372, down 0.4%. Broader markets extended breather after recent sharp up move, as the Nifty midcap, small cap dropped 1% and 0.6%, respectively.

* Sectorally, auto, consumption and IT relatively outperformed while financials and metals underwent profit booking.

* The weekly price action formed a high wave candle, indicating elevated volatility, after 12% sharp rally seen over preceding 3 weeks

* Key point to highlight over past 11 sessions is that, the index has been oscillating in ~500 points range (14750-14220), indicating breather with positive bias which would make market healthy ahead of key major event of Union Budget.

* Going ahead, we do not expect index to breach the strong support zone of 14000-13800. Hence, any dip from here on should be capitalized as incremental buying opportunity as we expect Nifty to head towards 14900 in coming month.

* In the process, stock specific activity would prevail as we proceed the Q3FY21 earning season. Our target of 14900 is based on a)138.2% extension of May-September rally (8806-11794), projected from September low of 10790, placed at 14919 b)Long term resistance trend line, drawn adjoining November 2010 March 2015 highs of 6334-9119, placed around 15000

* The broader market indices are undergoing slower pace of retracement as over past two weeks it has merely retraced 38% of preceding three weeks rally, indicating healthy consolidation, which has helped weekly stochastic oscillator to cool off the overbought condition (currently placed around 85). Going ahead, we expect broader market to regain upward momentum and relatively outperform the benchmark. Key point to highlight is that the Nifty midcap index has surged to new life-time highs, whereas small cap index is still ~22% away from all time high.Thus, we expect small caps to witness catch up activity

* Structurally, the Nifty has strong support base in the range of 14000- 13800 as it is confluence of 61.8% retracement of current up move (13131-14754) at 13751 coincided with January low of 13954

* The Nifty has maintained the rhythm of not correcting for more than 2-3 consecutive sessions, Since September low (10790). In the coming session, as index has already corrected for past 2 sessions, we expect the index to maintain the same rhythm by holding Friday’s low (14358). Hence, after a gap up opening use intraday dip towards 14400-14425 in Nifty January future for creating long position for target of 14514

NSE Nifty Weekly Candlestick Chart

Bank Nifty: 31167

Technical Outlook

* The Bank Nifty snapped a three week up move and closed lower by more than 3 % during previous week . The profit booking was broad based as both PSU and Private bank index closed lower by more than 3 % . Nifty bank index ended the week at 31167 , down by 1079 points or 3 . 3 %

* The weekly price action formed a sizable bear candle which engulfed previous two weeks price action highlighting profit booking, from vicinity of our target of 33000 , as prices reached overbought readings (weekly stochastics 92 ) after 13 % rally (28976 -32718 ) in just four weeks In the process index breached prior week low for firsts time in a month suggesting extended consolidation .

* Going forward, we expect consolidation in the broad range of 30800 -33000 . We believe the current leg of profit booking followed by higher base formation, after a sharp run up would make market healthier ahead of key major event of Union Budget . Therefore, investors should not construct the current profit booking as negative, rather utilize the same as an incremental buying opportunity to accumulate quality banking stocks

* The index has immediate support at 30800 -31000 levels, sustaining above which will lead to a pullback in the coming week . Failure to do so will signal extended correction towards 30000 levels . The immediate support of 30800 -31000 is based on the confluence of the following technical observations : a) 50 % retracement of the current up move (28976 -32842 ) placed at 30910 levels b)The rising 34 days EMA which has acted as a strong support since October is also placed around 30950 levels c)The upper band of the recent range breakout is also placed around 31000 levels

* In the coming session, the index is likely to open on a positive note on the back of firm Asian cues . Index after Friday’s sharp decline is placed near the support area of 31000 -30800 levels . We expect the index to hold above the same and witness a pullback . Hence, use intraday dips towards 31080 -31150 in Bank Nifty January future for long position for target of 31360 , maintain a stoploss of 30090

Bank Nifty Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Next resistance for Nifty is seen at 21530, which happens to be 78.6% extension level of the...