HSBC profit more than doubles, loan-loss fears ebb as economies rebound

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

HONG KONG/LONDON -HSBC Holdings beat forecasts on Monday with first-half pretax profit that more than doubled from last year when it set aside a huge amount of cash to cover pandemic-related bad loans.

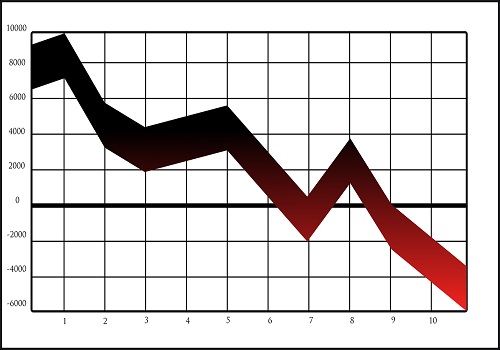

Encouraged by an economic rebound in its two biggest markets of Hong Kong and Britain, HSBC reinstated dividend payments and released $700 million that had been set aside as provisions. That compares with $6.9 billion in loan-loss charges made in the same period a year ago.

Pretax profit for Europe's biggest bank by assets came in at $10.8 billion, higher than the $4.32 billion logged in the same period a year earlier and a consensus estimate of $9.45 billion compiled by the bank.

Revenue, however, fell 4% due to a low interest rate environment for the bank, which makes bulk of its sales in Asia, and a weaker performance from its markets trading business compared to a strong first-half last year.

Growth is set to come from boosting assets under management in its wealth business and shifting more of its investment banking resources from Europe and the United States to Asia, Chief Executive Noel Quinn told Reuters.

"We're still in the early days of the economic rebound, we need to see all those numbers become the trend for the future, we are encouraged but there is more still to go," he said.

Quinn said he did not expect any decline in investment appetite for China after regulatory crackdowns have upended norms for the country's tech, property and private tutoring sectors, leaving some international investors bruised and uncertain.

"We see strong liquidity seeking investment opportunities in Hong Kong and Asia," he said.

HSBC's Hong Kong listed shares were last up 1.7% having trimmed gains in the morning when they rose as much as 4.9%.

INCOME SQUEEZE

Despite the headline profit surge, the earnings underscored that HSBC was, unlike its competitors, failing to benefit from a frenzy in stock listings and tech company fundraisings after having decided not to join the current boom in special purpose acquisition companies (SPACs) listings.

"It has been a very conscious decision to stay away from SPACs because that sector runs an elevated risk of litigation," Chief Financial Officer Ewen Stevenson told Reuters.

Revenue for HSBC's investment bank slid 23% in the second quarter against the same period a year ago at a time when U.S. banks and U.S.-focused rivals such as Barclays have seen strong performances.

The bank also saw pre-tax profit from Asia declining 5.9%, a drop Stevenson said was "almost entirely driven by the reduction in interest rates". Both longer and shorter term Hibors, the benchmark lending rates in Hong Kong were near 10-year lows for much of the quarter.

On a more positive note, HSBC said given the brighter outlook globally as economies recover faster than expected from the pandemic, it expects credit losses to be below its medium-term forecast of 0.3%-0.4% of its loans.

It said that for the year, it might be able to make a net release of funds from earlier provisions rather than add to them, but it was hard to say definitely due to the unknown impact of government support programmes, vaccine rollouts and new strains of the virus.

It also said it would move to within its target payout range of 40-55% of reported earnings per share within 2021.

HSBC plans to pay an interim dividend of seven cents a share after the Bank of England scrapped payout curbs last month. That compares with its interim dividend of $0.31 per share in pre-pandemic 2019.

(Reporting by Alun John in Hong Kong and Lawrence White in London; Editing by Edwina Gibbs)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">