Buoyant company earnings lift recession-focused markets

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

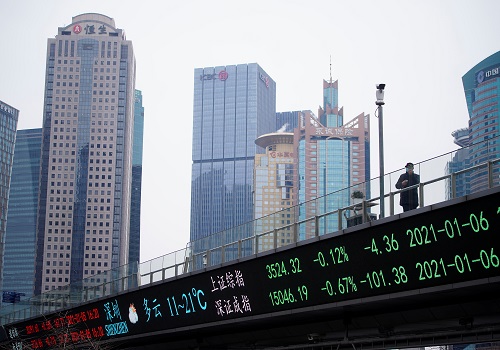

-Better-than-expected earnings from a raft of U.S. and European companies helped steady global stock markets on Wednesday, cutting through gloom caused by rising interest rates and the threat of an energy crunch due to Russian gas supply cuts.

Ten-year U.S. Treasury bond yields - the reference rate for global cost of capital - held near three-month lows touched on Tuesday, while several bond market recession gauges continued to flash warnings that growth in the world's largest economy is slowing, if not going into reverse.

Bond gains were capped, however, by the U.S. Federal Reserve meeting that is expected to deliver another big, 75 basis-point (bp) interest rate hike, and healthy second-quarter company earnings, despite cost pressures and labour shortages.

Futures for the U.S. S&P 500 and Nasdaq and rose 1% to 1.5%, while a pan-European equity index was up 0.4%.

Wall Street sentiment was lifted by 4%-5% gains on shares in Microsoft and Google parent Alphabet, which forecast strong revenue growth and posted solid search engine ad sales respectively.

In Europe, Deutsche Bank reported a forecast-beating profit rise as did Italy's Unicredit, boosting an index of European bank shares to a one-week high.

A range of sectors reported solid earnings too, from carmaker Mercedes Benz and luxury firm LVMH to energy firm Equinor and food producer Danone.

"Some great earnings numbers, especially from Big Tech and luxury goods," said Vincent Manuel, CIO at Indosuez Wealth Management, though he noted the divergence between buoyant earnings and softer macro sentiment.

"The question is how long we will continue to see this divergence?"

Earlier, heavyweight chipmakers helped Japan's Nikkei close higher, but a warning from the world's second-biggest chipmaker, SK Hynix, of slowing demand saw other Asian shares fall 0.5%.

Australian miner Rio Tinto too posted a 29% drop in first-half profits and more than halved dividends, citing weak Chinese demand, higher costs and labour shortages.

Indosuez's Manuel noted industrials and consumer discretionary firms better reflected the pressures than tech and healthcare firms.

"I would expect earnings guidance to be more cautious from corporates," he added.

GROWTH AND INFLATION

The growth-inflation trade-off will be on the Fed's mind when it announces its rate decision at 1800 GMT. While a 75 bps move is priced, futures still imply a 15% chance of a 100 bps increase.

Treasury markets are already anticipating that so many sharp near-term hikes will hurt longer-run growth, with ten-year yields firmly holding around 2.8%, around 25 bps below their two-year equivalent - the so-called curve inversion that often presages recessions [US/].

"(Company earnings) are helping equities but bonds are pricing in more economic weakness than equity markets," Nordea chief analyst Jan von Gerich said.

Uncertainty remains on the future Fed path, he noted, adding however that "what they are seeing on the activity side takes a bit of pressure off to do more."

Europe's situation is particularly fragile, with gas flows from Russia's Nord Stream 1 pipeline expected to halve on Wednesday from already reduced levels. That's sent energy prices zooming up, with German year-ahead prices at record highs.

The supply shortfalls and possible energy rationing were among issues highlighted by the International Monetary Fund (IMF) on Tuesday, when it cut global growth forecasts.

A complete cut-off of Russian gas to Europe by year-end and a further 30% drop in oil exports may lead to virtually zero European and U.S. growth next year, the IMF warned.

Those worries saw the euro post its biggest one-day loss in a fortnight, though it recouped 0.2% versus the dollar on Wednesday.

Another source of concern is Italy, after S&P Global cut its outlook on Italy's credit rating, sending 10-year bond yields 10 bps higher and its risk premium versus Germany to the highest in over a month.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">