Gold prices recovered from lows on Friday after data showed that US employment growth - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

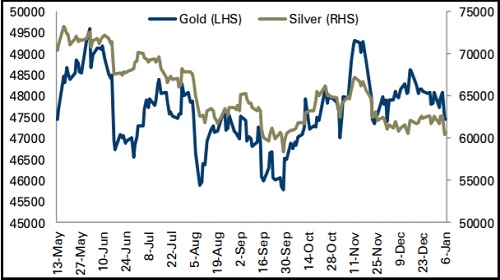

Bullion Outlook

• Gold prices recovered from lows on Friday after data showed that US employment growth was slower than expected last month. However, prices remained in the negative territory on a weekly basis as the Fed minutes signalled faster rate hikes

• US nonfarm payrolls rose by 199,000 last month amid worker shortages, which were lower than a forecast of 400,000, as spiralling Covid-19 infections disrupted economic activity

• However, the Fed minutes released last week showed officials had discussed shrinking the central bank’s overall asset holdings and raising rates sooner than expected to fight inflation

• Overall, gold and silver prices are likely to remain supported for the day as a fall in dollar index due to weaker US jobs report that is likely to make bullion cheaper for other currency holders

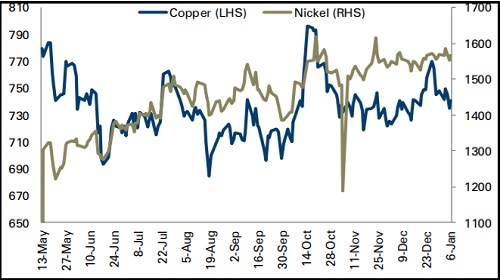

Base Metal Outlook

• Copper prices rose strongly on Friday as tensions rose again against Peru's Las Bambas mine, despite latest deal. Further, weaker dollar lent more support to greenback priced metals

• The Chinese-owned copper mine, which has faced repeated protests since it opened in 2016, is one of the biggest mines in Peru, the world's second largest copper producer where mining is a key source of tax revenue

• Meanwhile, global copper smelting activity was steady in December as a slowdown in China was offset by gains elsewhere, including other parts of Asia and North America, data from satellite surveillance of copper plants showed on Friday

• Copper prices are expected to trade positive for the day amid fresh supply concerns and multiyear low warehouse inventories

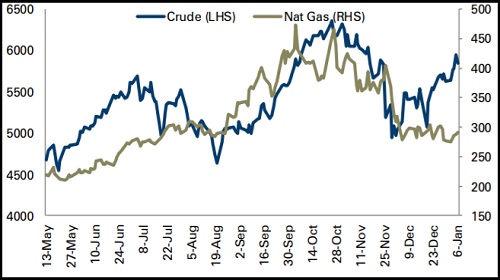

Energy Outlook

• Oil prices fell on Friday despite supply outages in Kazakhstan and Libya as a US jobs report missed market expectations and raised fresh demand concerns

• Production at Kazakhstan's top oilfield Tengiz was reduced on Thursday, its operator Chevron Corp said, as some contractors disrupted train lines in support of protests taking place across the central Asian country. Production in Libya has dropped to 729,000 barrels per day from a high of 1.3 million bpd last year, partly due to pipeline maintenance work

• Meanwhile, US oil and gas rig count, an early indicator of future output, rose by two to 588 in the week to January 7, its highest since April 2020, energy services firm Baker Hughes Co said on Friday

• Crude oil prices are expected to remain supported for the day amid fresh supply concerns and falling US inventories

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer