Gold is likely to take support near 52000 level and bounce back amid worries over rising inflationary pressure - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

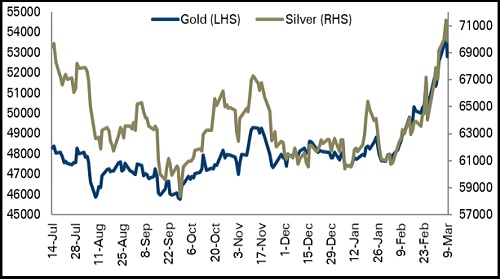

Bullion Outlook

Gold prices hit the brakes on a blistering rally and retreated from their high amid a rebound in US stocks and a surge in US treasury yields. US 10 year treasury yields edged up to 1.917% on Wednesday from 1.840% on Tuesday. Further, improved economic data from the US added downside pressure. US job openings stayed near record highs as worker shortages persisted

However, further downside was cushioned as uncertainty still prevails in the market. Further, a surge in crude oil prices has driven fears of inflation and burnished gold’s appeal as a hedge against inflationary pressure

Gold is likely to take support near 52000 level and bounce back amid worries over rising inflationary pressure. US CPI data is likely to show that inflation remained elevated at 7.9% in February 2022. Further, investors fear that mounting inflationary pressure and lower economic growth could collide when major central banks are on track to begin monetary tightening. The market will remain vigilant ahead of ECB’s monetary policy

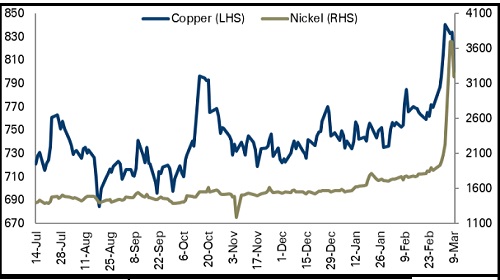

Base Metal Outlook

Base metal prices retreated from their high as investors are analysing the direction of conflict, western sanctions on Russia and their effect on the global economy. Market participants fear stagflation. A surge in commodity prices raised concerns over sticky inflation and lower economic growth

Indonesia said it will raise production capacity of nickel. It will add 39300 tons to 400000 tons this year bringing the total to as much as 1.4 million tons. Coordinating Minister for Investment and Maritime affairs Panjaitan said he was confident that with the additional capacity there is more than enough to offset any lost supply from Russia or other place

Industrial metal prices are expected to correct further on fears that Russia’s invasion of Ukraine massed fresh risk on the global economy, which is already struggling with elevated inflation and supply chains snarls. However, sharp downside may be cushioned on worries over supply disruption and declining inventories in LME registered warehouses

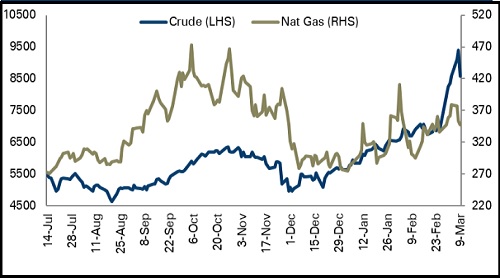

Energy Outlook

Crude oil prices fell on Wednesday on profit taking and speculation that a US ban on Russian oil may not worsen supply shock. Further, prices plunged as head of IEA said the agency could further tap oil stocks. Furthermore, media reports said Opec producers UAE and Iraq said they would support increased production

Additionally, prices dropped further on news that Russia and Ukraine are inching towards diplomacy. Russia announced a new ceasefire in Ukraine to let civilians flee besieged cities and Ukraine President has said he has cooled down regarding the question of Nato membership for his country. Meanwhile, a decline in US oil stockpiles prevented further downside in prices

Crude oil is expected to decline further for the day as markets assessed that the US ban on Russian oil may not worsen supply shock without the support from EU allies. Further, oil prices may correct on news that talks to restore the Iranian nuclear deal are set to resume and IEA is ready to bring more oil into the market by tapping oil stocks

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer