Gold is likely to continue its negative bias for the day -ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

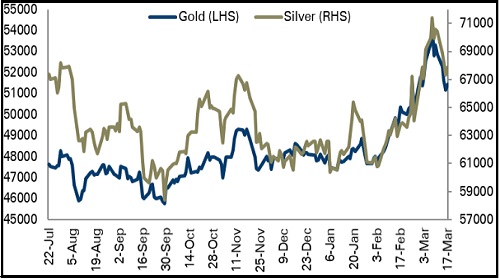

Bullion Outlook

Gold prices slipped on a strong dollar. Further, the US Federal Reserve decided to raise its benchmark interest rate by 0.25% and signalled six more increases by year end. Higher interest rates tend to raise the opportunity cost of holding non-interest paying gold. Further, demand for safe haven assets was dented as optimism over peace talks between Russia-Ukraine lifted sentiments in the wider financial markets

Gold is likely to continue its negative bias for the day amid a firm dollar and rise in US treasury yields. Further, demand for safe haven may decline on a rise in risk appetite in global markets. Hopes of progress in peace talks between Russia and Ukraine along with signs of confidence in the US economy from the Federal Reserve may lift sentiments in financial markets. Additionally, the US Federal Reserve’s decision to raise interest rates calmed fears among investors that inflation would spiral upward. As per FOMC economic projections, inflation is expected to come down from 4.1% to 2.6% in 2023 and 2.3% in 2024

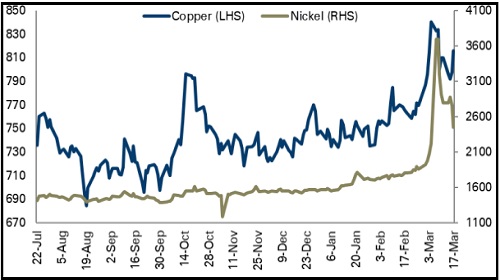

Base Metal Outlook

Base metal prices closed on a positive note amid a rise in risk appetite in global markets and Chinese stimulus hopes. Further, market supply has been tightened as a surge in Covid-19 cases disturbed logistics, to some extent. Additionally, London Metal Exchange copper committee recommended banning new supplies of the Russian metal from the bourses. However, a sharp upside was capped as the US Federal Reserve started raising interest rates to tame stubbornly high inflation and Bank of England raised its key interest rates for a third time

Industrial metal prices are expected to trade with a positive bias amid optimistic global market sentiments. Market sentiments improved on hopes of progress in peace talks between Russia and Ukraine along with signs of confidence in the US economy from the Fed. Fed sees US economy to be very strong and well positioned to handle tighter monetary policy. However, sharp upside may be capped on strong dollar and as investors will remain vigilant ahead of ECB President Lagarde’s speech and Fed Chair Powell’s speech

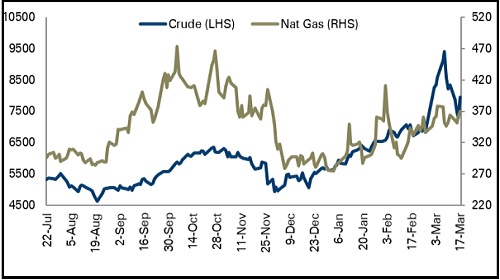

Energy Outlook

Crude oil prices rallied on worries over supply disruption due to tighter sanctions on Russia and falling oil stockpiles. Further, investors fear that if Russia and Ukraine fail to come to an agreement then there is the possibility of more sanctions on Russia. Russia said an agreement had yet to be reached after a fourth day of talks with Ukraine

Additionally, output from Opec+ producer group in February undershot targets even more than in the previous month. Furthermore, IEA said 3 million barrels per day of Russian oil and products may not find their way to the market beginning April in the wake of the invasion of Ukraine

Crude oil is expected to trade positive for the day amid worries over supply crunch and dwindling oil stockpiles. However, sharp upsides may be capped on hopes of progress in peace talks between Moscow and Ukraine. Furthermore, markets will keep an eye on talks between Iran and world powers over a nuclear agreement. If the deal is restored, then Iranian oil exports would help make up for the Russian barrels

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer