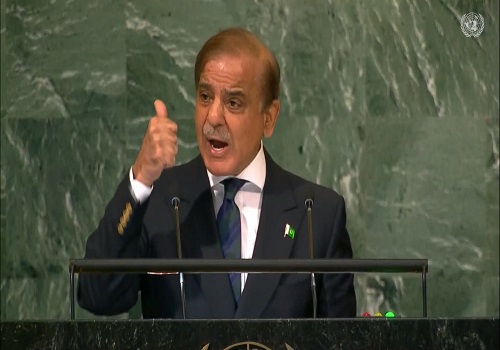

Global investors view Shehbaz's appeal as sign of imminent default on foreign debt

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The price of Pakistan's US dollar-denominated global bonds, Eurobond and Sukuk, slumped while their yields skyrocketed at world markets after Prime Minister Shehbaz Sharif appealed for debt relief from rich nations to cope with the flood-hit economy.

The global bond investors interpreted the prime minister's appeal as an indicator that the country was going to default on foreign debt repayments. Islamabad is scheduled to repay $1 billion against a maturing Sukuk on December 5, 2022, The , Express Tribune reported.

The prices of any country's bonds plunge and their yields - the rate of return - soar while they are facing a financial crisis and vice versa.

Earlier, the Financial Times while citing a UN policy memo, reported that Pakistan should suspend international debt repayments and restructure loans with creditors after recent floods added to the country's financial crisis.

The memorandum, which the UN Development Programme will share with Pakistan's government this week, states that the country's creditors should consider debt relief so that policymakers can prioritise financing its disaster response over loan repayment, the newspaper said.

The memo further proposed debt restructuring or swaps, where creditors would let go of repayments in exchange for Pakistan agreeing to invest in climate change-resilient infrastructure, FT said.

"Pakistan's dollar bonds maturing in 2022 fell by 12 per cent today (Friday) whereas dollar bonds maturing in 2024 and 2025 fell by 15 per cent and 17 per cent, respectively," Topline Research's analyst Umair Naseer said.

AHL Research reported the yield on the bond maturing in December 2022 skyrocketed by 6,560 basis points (bps) to a record high of 104.7 per cent.

Similarly, the yields on bonds maturing in 2024 and 2025 shot up to 60.7 per cent (up by 1,542 bps) and 39.2 per cent (up by 831 bps), respectively.

Pakistan's global bonds yields usually hover at much less than 10 per cent on normal days, The Express Tribune reported.

The bond investors felt high default risk despite the country's default risk being measured through CDS (currency default swap) and witnessed no major change during the day, Naseer said.

The country's foreign exchange reserves, however, have continued to decrease every passing week, as authorities partially make import payments and foreign debt repayments from the reserves amid low inflows.

The foreign exchange reserves have fast depleted to around half at $8.3 billion since January 2022.

They are barely enough for a six-week import cover at present despite it receiving $1.16 billion in loan tranche from International Monetary Fund (IMF) in early September, The Express Tribune reported.

Experts, however, strongly believe the reserves would build up again after IMF resumed its $6.5 billion loan programme on August 29, 2022. This will be followed by inflows from other multilateral and bilateral creditors including World Bank (WB) and Asian Development Bank (ADB).

Besides, the global community has pledged flood relief at around $1.5-2 billion. Their arrivals would also help boost the reserves.

The government has estimated reserves surging to around $16 billion by June 30, 2023

Anyhow, Finance Minister Miftah Ismail tried to clarify the situation arising out of Sharif's talk and win back the global bond investors' confidence later in the day on Friday.

"Given the climate-induced disaster in Pakistan, we are seeking debt relief from bilateral Paris Club creditors. We are neither seeking nor do we need, any relief from commercial banks or Eurobond creditors," Ismail tweeted.

"We have a $1 billion bond due in December which we will pay on time and in full. We have been servicing all our commercial debt and will continue to do so. Our Eurobond debt is only $8 billion due between now and 2051. That's not a large burden. Asignificant portion of our debt is from friendly countries who have said they will re-roll their deposits."

Since trade volumes on Pakistan's global bonds have reduced to low these days, therefore, "a small selling pressure on its dollar bonds could have resulted in sharp price fall, we believe", Topline Research's analyst said.

Ismail has reiterated the government's resolve to meet its debt obligations and continue with the reform process that has been initiated.

"Hence, we believe that the likelihood of Pakistan defaulting on its debt payment is low in the short run."

Further, the expected multilateral and bilateral flows post-floods are also likely to support pressure on the foreign exchange reserves of the country.

World Bank, Asian Development Bank, Asian Infrastructure Investment Bank and a few friendly countries have already committed flood-related aid/funding which could be to the tune of $1.5-2 billion

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">