Global commodity prices have surged in CY21, with the CRB core commodity index rising 70% YoY in April`21: Motilal Oswal Financial Services Limited

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Global commodity prices have surged in CY21, with the CRB core commodity index rising 70% YoY in Apr’21: Motilal Oswal Financial Services Limited

According to the India Strategy report of Motilal Oswal Financial Service, global commodity prices have surged in CY21, with the CRB core commodity index rising 70% YoY in Apr’21. The recent comments of Chinese policymakers have resulted in some moderation and volatility in prices. Nonetheless, the rise in global commodity prices in CY21 has brought the focus back on inflation. While food/agri prices have shown a faster increase, the CRB index is supported by a lower base of Apr'20. The rise in prices comes amid an increase in COVID cases and restricted economic activity. With the uncertainty in the demand environment, it would prove challenging for companies to pass on the rise in commodity costs.

In a constrained demand environment, due to broad-based lockdowns and macro uncertainty, corporates would be reluctant to pass on the higher input prices to consumers and would first exercise other P&L levers to manage margins. Sectors that are likely to be most impacted include Auto, Consumer Staples, and Consumer Durables. On the other hand, Metals and O&G (upstream companies) would be the clear beneficiaries of the surge in commodity prices.

Global inflation back in focus; implications for policymakers

Although the CRB index is partly supported by a low base (35% YoY decline in Apr’20), food/agri prices and base metals are showing a much faster and more robust increase vis-à-vis fuels and precious metals.

With the low base setting in up to Dec’21, inflation may continue to trend upwards. However, central banks across the world are likely to continue to look past this. If the high inflation trends sustain in CY22, this is likely to pose a concern for monetary authorities.

Another trend, however, may pose a concern for India. In the past decade or so, inflation trends in base metals and fuel commodities have followed each other very closely. Although global food prices have firmed up, the impact on India’s fundamentals remains limited. Furthermore, the share of industrial metals is also low (~10%) in WPI. Nevertheless, if fuel prices also start rising, similar to base metal prices, the situation for India could turn unfavourable very quickly.

Rising commodity prices to impact margins; cyclicals continue to benefit

Rising global commodity prices have historically had a positive impact on aggregate index earnings. For the last ~12 years, the trajectory of Nifty earnings has closely tracked the movement in commodity prices. While rising commodity prices benefit only 11 companies (22% of Nifty constituents), the profit share of these companies in Nifty FY22 earnings would be approximately 36% (v/s 31% in FY21E). On the other hand, the 13 Nifty constituents that are adversely impacted by higher commodity prices would contribute just ~11% to the Nifty FY22 profit pool.

Sectoral view

Global commodity prices are rising amid an increase in COVID cases and restricted economic activity. With the uncertainty in the demand environment, it would be difficult for companies to pass on the rise in commodity costs. Notably, the Auto, Consumer Staples, and Durables sectors would be highly impacted in such a scenario. In Banking, debt deleveraging by corporates has further impacted credit growth. More importantly, the uptick in inflation could signal the end of the monetary easing cycle, which has aided the steady decline in funding cost for the system, thus driving healthy margins.

Beneficiaries

The Metals and Oil & Gas sectors (upstream companies) would continue to be the biggest beneficiaries of the rising cost environment. For every change of USD5/bbl, EPS for ONGC / Oil India changes by 10%/16%. In Metals, the story of debt deleveraging continues as the net leverage for steel companies is also likely to decline to <1.5x in FY22 (vis-à-vis >5x at FY20-end).

Thus, on balance, we expect the impact of rising commodity costs on the Nifty to be limited. The adverse impact on Auto/Consumer/Durables margins would be counterbalanced by an earnings uptick in the Metals / Cement / Oil & Gas sectors. The IT sector, which constitutes ~15% of the Nifty weight, is broadly insulated from commodity inflation. That said, earnings in the non-Nifty, non-commodity basket may be adversely impacted given the weak demand backdrop in the economy due to widespread lockdowns.

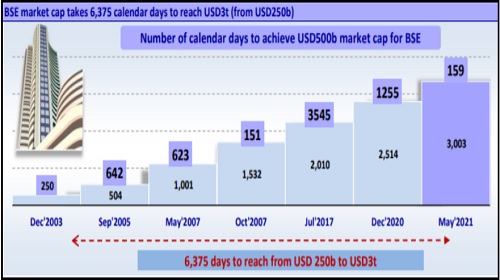

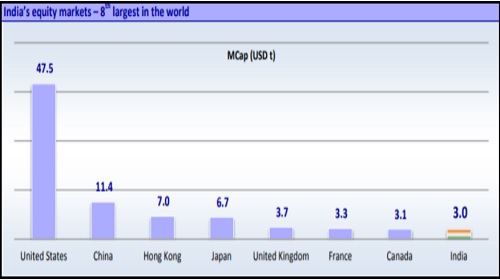

Indian Market Cap hits USD3t

India’s market-cap yesterday touched USD 3 trillion mark, a momentous milestone in an exhilarating journey. That it came amidst the uncertainty and volatility caused by once in a century pandemic, makes the milestone even more special. Global and Indian equity markets have seen an action packed CY20 with widespread lockdowns and restrictions impacting economies and corporate earnings. Amidst this chaos, market posted a sharp recovery in 2HCY20 and further built on it in CY21 so far. As the 2nd Covid-19 wave recedes in India (active cases down ~1/3rd in 3 weeks from the recent peak) and pace of vaccination picks up in rest of the CY21, we hope and expect the journey will become little smoother.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer