Global Markets: Asian shares pulled higher by China, eyes on Fed, U.S. GDP

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

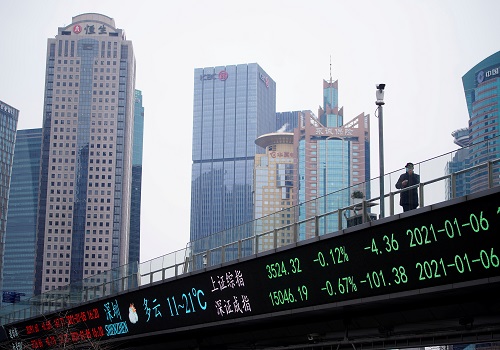

Asian stocks rose on Monday with Chinese shares near three-week highs as signs the world economic recovery was well on track bolstered risk appetite, while the U.S. dollar slipped to a two-month low.

MSCI's broadest index of Asia-Pacific shares outside Japan jumped 0.3% to surpass critical chart resistance of 700 points and reach its highest since March 18.

The index has had a strong run lately as it clocked its second consecutive weekly rise on Friday and was on track for another month of gains. Since April 2020, the index has offered positive returns in all but three months.

Chinese shares were firm with the blue-chip CSI 300 index up 0.4% to its highest since Apr. 6.

South Korea's KOSPI index rose 0.4% while New Zealand shares added 0.6%.

Japan's Nikkei reversed early losses to be up 0.1% while Australia's benchmark share index was off a touch with a public holiday in five of the country's eight states and territories.

Risk appetite was whetted by early April manufacturing activity indicators out last week, which pointed to a robust start to the second-quarter with data hitting record highs in the United States and signalling an end to Europe's double dip recession.

Investors embraced the strong data, shrugging off earlier concerns about potential higher U.S. taxes on capital gains under the Biden administration.

On Friday, U.S. shares ended firmer with the S&P 500 hitting a record intraday peak to end 1.1% higher. The Dow rose 0.7% while the Nasdaq Composite added 1.4%.

E-mini futures for the S&P 500 gave up early losses to be flat on Monday.

First-quarter U.S. gross domestic product data is due later in the week with expectations activity will have likely returned to pre-pandemic levels.

"We estimate that the economy will close the output gap and rise above potential in the second half of this year," ANZ economists wrote in a morning note, suggesting more upside for shares.

Europe "cannot match this, but as 2021 progresses into 2022, the growth differential to the U.S. will narrow."

That said, some economists say the market could hit a soft patch in coming months reflecting concerns ranging from rising COVID-19 cases and worries that most of the benefits from massive fiscal stimulus have already been priced in.

"Stated differently, this may be the last quarter where companies can avoid being penalized for not seeing revenue recover quickly and/or not giving guidance," JPMorgan analysts wrote in a note.

They said the "bull case" for equities would be supported by reopening from coronavirus lockdowns, consumer spending and corporate earnings combined with reduced market volatility.

The "bear case", on the other hand, would be triggered by inflation, delays to re-opening, weaker economic growth and corporate profits and a commodity recession.

Strong recent data meant bonds were sold off, though 10-year U.S. Treasury yields were not far from a recent six-week low on expectations the U.S. Federal Reserve will stay accommodative at its meeting this week.

In currencies, Turkey's lira edged lower adding to a recent slide and nearing an all-time low as a chill settled on relations with the United States and after the new central bank chief signalled that rate hikes would harm the economy.

The U.S. dollar's index slipped to 90.739 against a basket of major currencies, a level not seen since March 3.

The greenback was a shade weaker on the safe-haven Japanese yen at 107.76. The euro rose 0.1% at $1.2105. The risk sensitive Australian dollar stayed trapped in a narrow band to be last at $0.7762.

In commodities, U.S. crude rose 4 cents to $62.18 per barrel and Brent was flat at $66.11.

Gold climbed 0.1% to $1,778.92 an ounce.