Global Markets: Asian shares, oil buoyant on economic revival hopes

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

By Swati Pandey

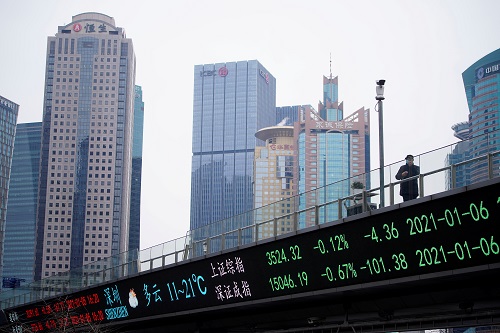

SYDNEY - Asian shares hovered near record highs on Monday while oil edged closer to $60 a barrel on hopes a $1.9 trillion COVID-19 aid package will be passed by U.S. lawmakers as soon as this month just as coronavirus vaccines are being rolled out globally.

MSCI's broadest index of Asia-Pacific shares outside Japan was last up 0.3% at 717.2 after climbing as high as 730.16 late last month.

Japan's Nikkei jumped 2% while Australian shares advanced 0.8% led by technology and mining shares. Chinese shares were mildly positive with the blue-chip CSI300 index up 0.1%.

E-mini futures for the S&P 500 added 0.4% in early Asian trading.

Hopes of a quicker economic revival and supply curbs by producer group OPEC and its allies pushed oil to its highest level in a year as it edged near $60 a barrel.

Global equity markets have scaled record highs in recent days on hopes of faster economic revival led by successful vaccine rollouts and expectations of a large U.S. pandemic relief package.

On Friday, the Nasdaq and S&P 500 hit all-time highs on stronger-than-expected corporate results in the fourth quarter and as companies were on track to post earnings growth for the first quarter instead of a decline.

The rallies came even as U.S. data painted a dour picture of the country's labour market with payrolls rising by 49,000, half of what economists were expecting.

The weak report spurred the push for more stimulus, underscoring the need for lawmakers to act on President Joe Biden's $1.9 trillion COVID-19 relief package.

Biden and his Democratic allies in Congress forged ahead with their stimulus plan on Friday as lawmakers approved a budget outline that will allow them to muscle through in the coming weeks without Republican support.

U.S. Treasury Secretary Janet Yallen predicted the United States would hit full employment next year if Congress can pass its support package.

"That's a big call given full employment is 4.1%, but one that will sit well with the market at a time when the vaccination program is being rolled out efficiently in a number of countries," said Chris Weston, Melbourne-based chief strategist at Pepperstone.

Expectations of a U.S. economic recovery have not boosted the greenback though, "because this shift in prospects is seen by the market as part of a global recovery," Westpac economists wrote in a note.

"Investors therefore favour risk taking, and so value the safety of the U.S. dollar less."

Indeed, the greenback came off a four-month high against the Japanese yen to be last at 105.49.

The euro was a tad weaker after rising 0.7% on Friday to a one-week high of $1.2054. It was last at $1.2034.

The risk-sensitive Australian dollar eased from a one-week high to $0.7675.

In commodities, Brent crude and U.S. crude climbed 59 cents each to $59.93 and $0.57.44 respectively.

U.S. gold futures were up 0.1% at $1,815.4 an ounce.

(Editing by Shri Navaratnam)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">