Futures slip for fourth day with focus on inflation data

U.S. stock index futures fell for the fourth session on Thursday as investors awaited producer prices data, another inflation gauge, to see if a rise in prices would be strong enough to prompt a sooner-than-expected increase in interest rates.

The Labor Department's data is likely to show U.S. producer prices rose 0.3% last month after a gain of 1% in March. A separate report is expected to indicate claims for U.S. unemployment benefits was below 500,000 in the latest week, for the third time in a row.

A surge in commodity prices, labor shortage along with a much stronger-than-expected consumer prices data this week have stoked concerns that the U.S. Federal Reserve might consider pulling back its crisis levels of support despite its reassurances that the rise in prices to be temporary.

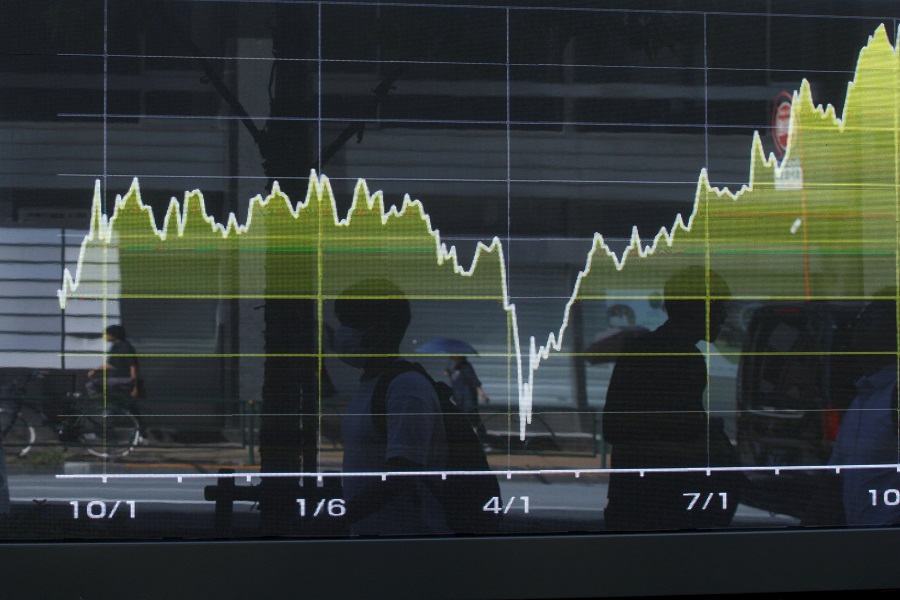

Losses this week have pulled the S&P 500 4% off its record closing high on Friday, while the tech-heavy Nasdaq is about 8% below its April 29 all-time high.

The CBOE volatility index, a measure of investor anxiety, has surged to its highest levels in more than two months to 27.63 points.

At 6:37 a.m. ET, Dow e-minis were down 189 points, or 0.56%, S&P 500 e-minis were down 15 points, or 0.37%, and Nasdaq 100 e-minis were down 37.25 points, or 0.29%.

Shares in oil major Exxon Mobil and copper miner Freeport-McMoran dropped, tracking a fall in commodity prices, while lenders, including Bank of America and Goldman Sachs fell 0.8% and 1.7% in premarket trading.

Dating app owner Bumble Inc slipped 1% despite forecasting current-quarter revenue above estimates. The stock has shed about 19% of its value in the past three sessions.

Walt Disney's shares dropped 1.6% ahead of its second-quarter results due after the closing bell.

Tesla Inc shed 1.5% as its chief executive, Elon Musk, said the company will no longer accept bitcoin for car purchases, a swift reversal in the company's position on the cryptocurrency. Bitcoin prices clawed back some losses after Musk's comment shaved 13% off its value on Wednesday.