Fast moving companies slow moving stocks by Ventura Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

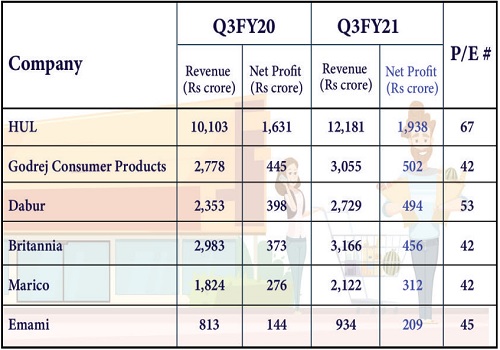

Q3FY21 has been an impressive quarter for most FMCG companies that have reported numbers so far, with many of them witnessing double digit profit growth and a healthy volume growth.

The strong growth momentum in the rural and semi-urban areas remained a major driving force for frontline FMCG companies, such as HUL and Britannia to name a few, in Q3FY21 as well, like that in the last few quarters. Health & Hygiene segment, which got redefined during the pandemic period, continued to drive the top line growth of leading FMCG companies.

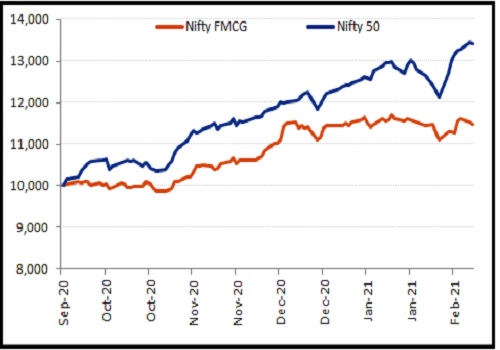

FMCG companies have witnessed a substantial growth in the share of e-commerce in their revenues, albeit on a small base. Frontline companies expect to grow their direct reach and the rural footprint. They have also been investing in technology and supply chains to accelerate digital and modern trade revenues, going forward. Be that as it may, FMCG stocks have collectively underperformed the broader markets over the past few months. Intense competition, inflationary pressures and rich valuations seem to have discouraged investors from betting big on them.

HUL witnessed a 2% fall in its homecare business which accounted for 29% of its revenue in Q3FY21. Beauty and personal care business constituted 42% of the top line and reported 9% growth, whereas, Food and Refreshment category saw a healthy 19% revenue growth. Horlicks and Boost have clocked a double-digit growth.

HUL has been keeping tabs on the inflationary trend witnessed in agricultural commodities such as tea and palm oil since it exerts pressure on margins. However, it isn’t ready to lose the customer for margins—volume growth and customer loyalty still remain the core of its profitable volume growth strategy.

But not all companies were reluctant to pass on the impact of price escalation in raw materials to consumers.

For instance, Marico decided to hike prices in the range of 7% to 19% across the Saffola Edible Oils category. It’s noteworthy that, despite price hikes, Saffola refined edible oils volumes grew 17% in Q3FY21 on a Y-o-Y basis. The company cut back on ad spends as well to protect margins.

Marico: raw material prices rising to the sun?

Marico launched several new products such as Saffola Chyawan Amrut and Soya Nuggets in the Foods category. As a result, the Foods division witnessed a spectacular 74% growth in value terms. According to the management commentary, increased household consumption and growing awareness about healthy cooking has been offering tailwinds. Marico expects premiumization, foods and digital revenues would be the key growth levers, going forward. Volume and margin guidance of Marico remains strong. Over the medium term, the company expects to clock double digit volume growth in its India business and maintain the operating margin upwards of 19%. The India business made up 77% of the company’s revenue in Q3FY21. Marico reported 15% growth in domestic volumes.

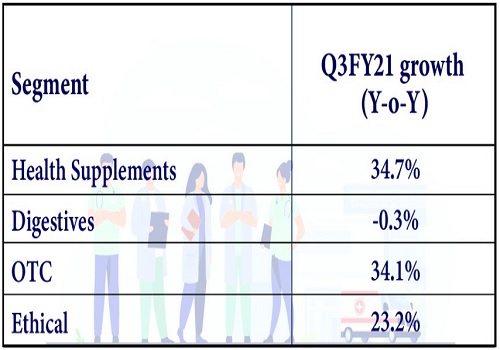

Dabur announced the highest ever quarterly revenue and net profit in Q3FY21. The healthcare division remained the mainstay of the company which accounted for 44% of its top line. Dabur launched several products in Healthcare as well as Home and Personal Care categories. Healthcare revenues jumped 28.1% Y-o-Y during the quarter gone by. The market share of Dabur in the Chyawanprash category improved 120 Basis Points (bps). The market share gain of 700 bps in Honey has been astonishing.

The company gained market share across prominent subcategories of Home and Personal Care—oral care, hair care and fresheners etc. The company has managed to maintain its EBITDA margins on Y-o-Y basis.

Emami declared a 13% volume growth in domestic business with Zandu Healthcare range witnessing a massive 38% growth. The company had launched a dedicated online platform, zanducare.com in Q2FY21. According to the company management, it has helped accelerate the segmental revenues. Interestingly, Emami has reported an all-time high EBITDA margin of 36.4% in Q3FY21—a gain of 390 bps Y-o-Y. The management doesn’t expect a big difference in margins going forward.

Emami launched 30 new products in the past few quarters, mostly in rural areas through the retail channel. It expects at least 5-6 of them to take off. The company aims to back them with further investments and introduce them in the wholesale channel as well. Emami has been in the process of identifying villages to reach out directly. It intends to invest in human resources to grow its business in the top four states. E-commerce revenue of the company has increased 3.5 times in Q3FY21 to 3.1% of domestic business. Modern trade contributes nearly 9% of the domestic revenues.

Emami has been hoping to double its e-commerce revenue for which it’s open to take the acquisition route.

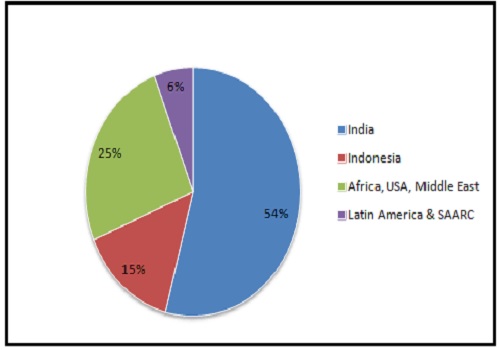

Godrej Consumer Products Limited (GCPL) which derives nearly 46% of its revenues from overseas markets saw its global business negating the margin impact on domestic business. While domestic EBITDA margins declined ~80bps, the company reported overall margin gains of ~70bps.

GCPL: contribution of different geographies in revenue

Nearly 81% of the company’s product portfolio delivered 14% value growth. This has been the second consecutive quarter of double digit growth for GCPL. That said, the street was concerned about Household Insecticide (HI) business growing at just 7% in India and 5% in the global markets.

According to the company management, entry level market and the premium format has done well within the HI segment. The burning segment has played the spoilsport. Non-mosquito products in the HI segment have experienced over 20% growth.

The GCPL management shared an interesting observation: high inflationary environment has historically resulted in the company gaining market share as smaller and regional players find it difficult to tackle margin pressures.

Britannia shared a similar view. In the post earnings conversation, the management highlighted the importance of the affordability element, along with the stress on the unorganized market at present. Britannia has gained market share in Q3FY21 for the 37th consecutive quarter. There were fewer new product launches during the quarter gone by. Direct dispatches as a percentage of revenue have gone up 320 bps and now make up 23% of the top line.

Britannia: trends in the operating profit margins

Pantry normalization and the poor performance of otherwise big consumption areas such as transit clusters, offices, schools, etc., affected the performance of cakes and biscuits categories.

Britannia launched a new product in the Crème Wafers category in the quarter gone by. Going forward, the company expects to further strengthen its position in the Wafers category. At present, it’s a number two player in the segment. The company has a strong capex pipeline. It is building a plant in Tamil Nadu to tap exciting and innovative growth opportunities. The company is likely to complete its Rs 1,500-crore capex project at Ranjangaon in Maharashtra in 2024. Nearly 50% of the planned investment has already been made. Britannia aims to strengthen its ESG compliance, introduce new and innovative products across categories, strengthen its distribution, especially in the Hindi belt and reap efficiency benefits by cautiously investing in technology.

Return on Technology Investment (ROTI) will matter the most…

Investments in technology are likely to foster revenue growth and expected to be margin accretive for leading FMCG companies. Technology transformation can result in cost reductions, better inventory management and optimization of supply chains. Moreover, it may immensely help companies understand consumer behaviour and launch more targeted products. For instance, an algo-driven distribution model has been helping HUL leverage its nationwide retail coverage. HUL is hoping to see its distribution network delivering big gains once its SAP Integration and CD system Integration is completed. Similarly, Britannia has already undertaken a big IT transformation which it hopes to complete by Q4FY21. It has planned a complete overhaul of ERP system and is replacing an old Dealer Management System (DMS), installed about 15 years back, with a new AI-driven integrated DMS and a Vendor Management System.

Concluding thoughts…

High valuation and margin compression is an insipid recipe for FMCG companies. However, as inflationary pressures build up and smaller players get squeezed, leading FMCG companies are likely to gain market share. Market share gains, new product launches and technological preparedness will be the important factors to track over the next few quarters.

Above views are of the author and not of the website kindly read disclaimer

.jpg)