Expiry Express - Bank Nifty opened gap up and witnessed quick buying and positive action By Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

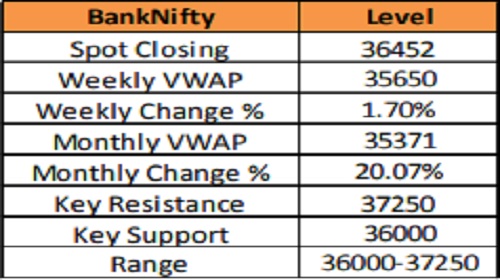

BANKNIFTY : 36452

Bank Nifty opened gap up and witnessed quick buying and positive action in all the banking stocks. It made intraday high of 36567 and ended the day with massive gains of more than 1300 points. It formed a strong Bullish candle on daily scale and negated its formation of lower highs - lower lows of the last five sessions. Now it has to continue to hold above 36000 zones to witness an up move towards 37000 and 37250 zones while on the downside support exists at 36000 and 35700 zones

Expiry day point of view: Overall trend is likely to remain volatile with bullish bias Now till it holds above 36000 zones bounce could be seen towards 37000 then 37250 zones. Option traders are suggested to trade with nearby 36600, 36700 Call and Bull Call Spread.

Trading Range: Expected wider trading range : 36000 to 37000/37250 zones Option Writing : Aggressive Option writers can sell 37800 Call and sell 35200 Put with strict double SL Weekly & Monthly Change : Bank Nifty is up by 20.07% in this series at 36452 on expiry to expiry basis as Jan 2020 series settled at 30358. Bank Nifty is trading 1080 points higher from its Series VWAP of 35370 and 800 points higher from its Weekly VWAP of 35650 levels which suggests bullish bias and more scope for short covering.

Key Data

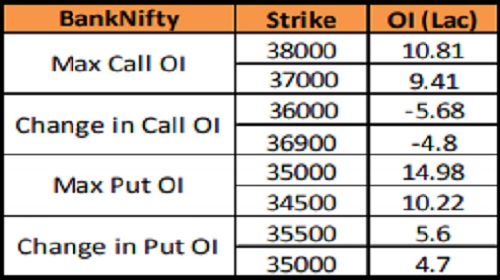

Option Weekly Activity

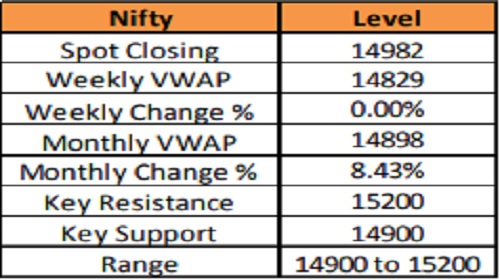

NIFTY : 14982

Nifty index opened above 14700 zones and continued its momentum on a positive note for most part of the session. However a trading halt was witnessed due to unforeseen circumstances at NSE exchange but that couldn't stop the bull's grip. Index picked up sharply in the second part of the session and managed to hit psychological 15000 mark. It closed the day with gains of around 275 points. It formed a strong Bullish candle on daily scale and negated its formation of lower highs of the last five trading sessions. Now, it has to continue to hold above 14900 zones to extend its move towards 15150 then 15250 zones while on the downside immediate support exists at 14850 and 14700 levels.

Expiry day point of view: Now till it remains above 14900 zones it could extend its move towards 15150 then 15250 zones. Option traders are suggested to be with positive bias till it holds below 14900 zones. One can Buy nearby Call like 15000, 15050 and Bull Call Ladder Spread

Trading Range : Expected wider trading range : 14900 to 15200 zones. Option Writing : Aggressive Option writers can sell 15200 Call and 14850 Put with double the SL

Weekly Change : Nifty index is up by 8.43% in this series at 14982 on expiry to expiry basis as Jan series settled at 13817. Nifty VWAP of this series is near to 14900 and Index is trading 80 points above from VWAP levels while it up by 150 points from its weekly VWAP of 14830 levels which suggests overall bullish bias.

Key Data

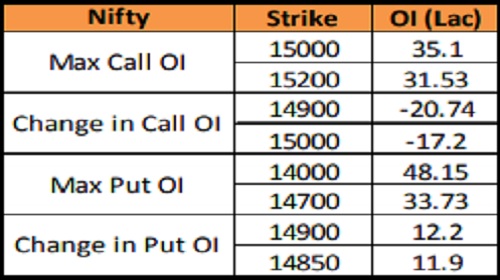

Option Weekly Activity

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Benchmark index opened on a positive note and traded higher before closing with 0.95% gain a...