Evening Roundup : A Daily Report on Bullion, Energy & Base Metals for 16 August 2022 By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BULLION

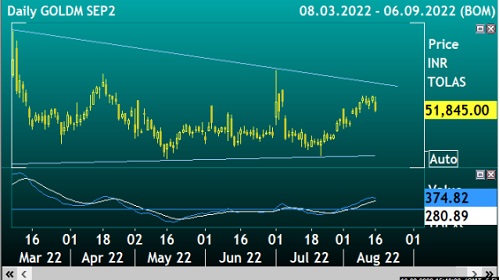

GOLD

By breaking off the downside hindrance of 51680 may be sign of further weakness in the session ahead. Else hold the same for prices to rebound higher in the later session.

SILVER

Witnessing weakness may persist towards the downside objective of 57650 or even lower. Even in this bearish expectation, a direct rise above 58900 may lift prices higher in the later session.

CRUDEOIL

Decisive trades above 7200 may induce fresh buying in the session ahead. Botched attempt to achieve such trades may bid further weakness to the counter.

NATURAL GAS

Consecutive days of buying sentiments largely to stretch towards the upside objective of 724 region or even more. But a corrective dip below 692 may squeeze down prices lower.

BASE METALS

Copper

Present buying sentiments may withstand only by decisive trades above 673 region. Which if remain undisturbed may push prices lower in the later session.

NICKEL

Present life less trades largely to continue in the upcoming session within the trading range of 1950-1845.

Zinc

Ensuing buying sentiments may continue if prices stay above 323 region. Although a direct dip below the same may squeeze down prices lower.

Lead

Consolidation likely to progress in the coming session within the trading range of 182.80-185.50. A firm move which breaks either side of the aforesaid region could set the trend.

Aluminium

Intraday move is expected to be northbound if prices remain above the downside hurdle of 208.50 region. But slippage below the same may induce fresh selling in the session ahead.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Intraday Technical Outlook 20 April 2022 - Geojit Financial Services