Evening Roundup : A Daily Report on Bullion, Energy & Base Metals for 12 August 2022 By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BULLION

GOLD

As we said yesterday, buying sentiments may strengthen only by decisive trades above 52420 region. Which if remain undisturbed may eventually push prices lower.

SILVER

As long the trend line resistance of 59800 is not breached, possibility of upside movement can be ruled out. It would also lead to corrective dips in the counter

CRUDEOIL

Prices may appear firmer above the falling trend line resistance of 7600 region. Whereas inability to break the same level may induce corrective dips

NATURAL GAS

Voluminous break above 705 region may strengthen the prices. Meanwhile, a dip below 678 may induce weakness as well.

BASE METALS

Copper

Divergence in MACD oscillators suggest the possibility of positivity in the counter. However, in order to sustain the upward momentum, prices need to break above the Bollinger upper band region of 684.40. Or else, corrective dips may be witnessed

NICKEL

Prices consolidation likely to continue with limited trades.

Zinc

Next phase of buying expected only above 326.80 region. Else, slip below 322 may induce further weakness.

Lead

Intraday move expected to be moderate with range bound moves, while a voluminous rise above 185.70 may strengthen the prices.

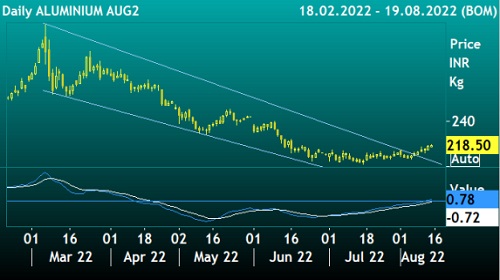

Aluminium

Widening bullish divergence in MACD lines suggest positivity prevailing in the counter. Meanwhile, unexpected dip below 216 may induce weakness.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer