Equity benchmarks extended their breather over a second consecutive session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

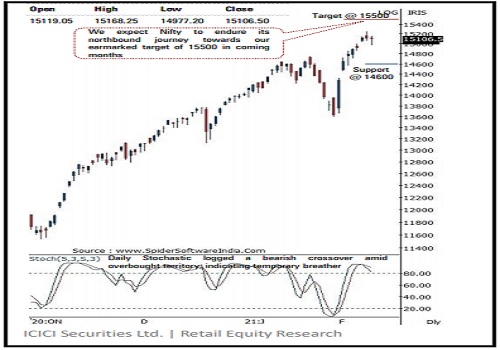

NSE (Nifty):15106

Technical Outlook

* Equity benchmarks extended their breather over a second consecutive session and ended on a flat note. The Nifty closed a tad below the previous session’s close, at 15106, down 3 points. The market breadth turned flat. The broader market relatively outperformed the benchmark as Nifty midcap, small cap advanced over 0.7%, each. Sectorally, auto, pharma outshone while financials took a breather.

* The daily price action formed a high wave candle carrying shadows on either side, highlighting stock specific action amid elevated volatility. Despite initial sell-off, buying demand emerged from the psychological support of 15000 at the fag end of the session. This helped the index to recover 165 points from day’s low and end above previous session’s low of 15064, indicating overall positive bias

* Formation of higher peak, trough on larger degree chart signifies robust price structure making us confident to reiterate our positive stance on the index. We expect it to gradually head towards our earmarked target of 15500 in coming month.

* We believe the ongoing breather amid stock specific action would help the index to cool off overbought condition of daily stochastic oscillator (currently at 84) formed due to past seven session’s 1660 points sharp rally and make market healthy. Thus, our strategy of capitalising on dips to go long in quality large cap and midcap has been working well as we expect the index to unfold the next leg of rally towards 15500 that is 161.8% external retracement of past two week’s fall (14754-13596), at 15466

* In line with our view, broader market endured its northbound journey and relatively outperformed the benchmarks. In the process, the Nifty Midcap index clocked a fresh record high. However, small cap index is still ~20% away from its all-time high. Therefore, we expect small caps to witness catch up activity within broader market space

* Structurally, we do not expect the index to breach the key support threshold of 14600. Hence, any temporary breather from here on should not be construed as negative. Instead, it should be capitalised on to accumulate quality stocks as we expect elevated buying demand to emerge around 14600, since it is confluence of 38.2% retracement of current up move (13597-15257), placed at 14622 coincided with earlier consolidation breakout area around 14650 In the coming session, volatility would remain high owing to weekly derivative expiry sessions.

* However, we expect the index to hold Wednesday’s low (spot-14977) and trade with a positive bias. Hence, use intraday dips towards 14986-15012 to create fresh long position for the target of 15096.

NSE Nifty Daily Candlestick Chart

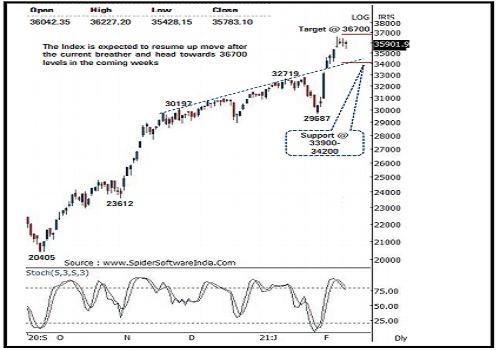

Bank Nifty: 35783

Technical Outlook

* The Nifty Bank index traded in a range with corrective bias to close lower by 0 . 8 % on Wednesday to snap a nine consecutive sessions up move . The profit booking was lead by the private banking stocks as the Nifty private bank index closed lower by 0.8%, while the PSU bank Index closed on a flat note. The Bank Nifty closed at 35783 down by 273 points or 0 . 8 %

* The daily price action formed a third consecutive high wave candle signalling a breather after a gain of more than 23 % in the preceding seven sessions . The low of Wednesday session is placed at the last Friday’s bullish gap area (35344 - 35545 ) sustaining above the same will lead to a pullback in the coming sessions . Failure to do so will lead to an extended correction

* Key point to highlight is that after a rally of 6900 points in just seven sessions the daily stochastic has approached to overbought trajectory which has resulted in a sideways consolidation in the last three sessions . The current breather should not be seen as negative instead one should adopt buy on decline strategy as the overall structure remain firmly positive for up move towards 36700 levels as it is the 123 . 6 % external retracement of entire CY20 decline (32613 - 16116 )

* The short term support for the index is placed around 34200 - 33900 levels as it is the confluence of the following : a) 38 . 2 % retracement of the current up move 29687 to 36615 is placed around 33968 levels b) Value of a bullish gap post Budget day at 33583 levels c) The value of the rising trendline joining recent high since November 2020 is also placed around 34200 levels

* In the coming session, the index is likely to open on a negative note tracking global cues . We expect index to trade with a positive bias while holding above Wednesday low (35428 ) .

* Hence , after a negative opening we recommend to utilize intra day dips towards 35620 -35665 create fresh long positions in Bank Nifty February Futures to for target of 35798 meanwhile stop loss is placed at 35558

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct