Domestic indices likely to start holiday shortened week in red

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

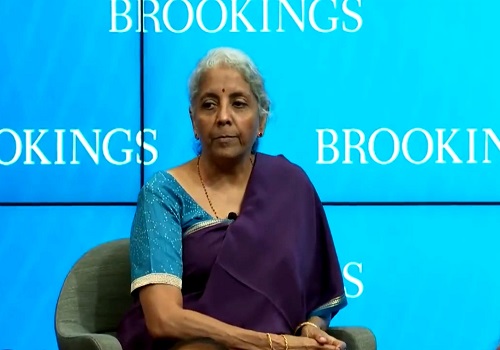

Indian markets ended a sluggish session on Friday with mild gains, as strength in pharma and select financial stocks was countered by weakness in auto stocks. Today, the markets are likely to start holiday shortened week in red amid concerns of rise in geo-political tensions after Russian missiles hit a large Ukrainian base near NATO-member Poland's border on Sunday. Investors will keenly watch out for the February WPI data, and the retail inflation figures that are scheduled to come later in the day. Traders will be concerned as Reserve Bank of India deputy governor Michael Patra said India's growth story remains as weak as it was during the 2013 taper tantrum and recent geopolitical tensions in Ukraine and Russia are further likely to hurt a recovery. There will be some cautiousness as a private report cut India's GDP forecast for the fiscal year beginning April 1 by 50 basis points to 7.9 per cent, as higher oil prices torpedo economic recovery worldwide, and raised retail inflation projection to 6 per cent and expects current account deficit to widen to 3 per cent of GDP. However, some respite may come later in the day as Commerce and Industry Minister Piyush Goyal said the country's merchandise exports have reached over $380 billion so far this fiscal till March 7 and are expected to reach $410 billion in 2021-22. Some support may come as finance minister Nirmala Sitharaman said rising internet penetration, growing income and the high number of young people will likely drive up the size of India’s digital economy to as much as $800 billion by 2030. On the macro-economic data front, India's industrial growth in the month of January grew 1.3% year-on-year. It had slumped to a 10-month low of 0.4% in December 2021. Besides, the RBI data showed the country’s foreign exchange reserves increased by $394 million to $631.92 billion in the week ended March 4. There will be some buzz in the jewelry industry stocks with government data showing that India’s gold imports surged by about 73 per cent to $45.1 billion during April-February this fiscal on account of higher demand. There will be some reaction in tea industry stocks as a body of tea planters said exports of the commodity will be adversely impacted due to the Russia-Ukraine conflict. Banking stocks will be in focus as Fitch Ratings stated that moderate pressures on asset quality of Indian banks may re-emerge as forbearance starts to unwind from 2023.

The US markets ended lower on Friday as tech and growth shares led a broad decline and investors worried about the conflict in Ukraine. Asian markets are trading mixed on Monday as investors remain cautious on Russia-Ukraine talks.

Back home, Indian equity benchmarks managed to end higher for the fourth straight session on Friday led by gains in Auto, Telecom and TECK stocks. The domestic indices swung between green and red terrain in a highly volatile session, as traders got anxious with a private brokerage firm sharply cut its India FY23 real GDP growth estimate to 7.9 per cent, mainly due to the impact of the Russia-Ukraine conflict on oil prices. Some cautiousness also came with Kristalina Georgieva, the Managing Director (MD) of the International Monetary Fund (IMF) stating that India has been very good at managing its finances but the surge in global energy prices is going to have a negative impact on its economy. She observed that the war has posed a challenge to economies around the world, including India. Adding to the pessimism, the Reserve Bank of India (RBI) in its data indicated that India Inc's direct overseas investment declined 67 per cent to $753.61 million in February 2022. The domestic investors had invested over $2.28 billion in overseas ventures as part of the outward foreign direct investment (OFDI) in February 2021. However, key indices managed to end in green terrain, taking support from rating agency Crisil’s report that Indian economy is likely to grow by 7.8 per cent in 2022-23, mainly driven by the government’s drive to push infrastructure spending and likely increase in private capital expenditure. Some optimism also came with Fitch Ratings stating that strengthening economic recovery and stable financial metrics will help state-owned banks have stable earnings during the next financial year, aided by the gradual unwinding of regulatory forbearance through the year. Separately, with an aim to promote and support untapped creativity of MSME sector, Union Minister for MSME Narayan Rane has launched the MSME Innovative Scheme (Incubation, Design and IPR) along with the MSME Idea Hackathon 2022. Rane further said that MSMEs have an important role to play in Atmanirbhar Bharat. He said these schemes will help entrepreneurs in developing new ventures. Finally, the BSE Sensex rose 85.91 points or 0.15% to 55,550.30 and the CNX Nifty was up by 35.55 points or 0.21% to 16,630.45.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...